Welcome back,

Successfully building a profitable real estate investing business requires a good deal of effort and consistent daily action. A “successful” mobile home investing business for many investors may be considered at least 1 used mobile home deal closed and resold per month. These manufactured homes are usually added to a portfolio of performing properties paying you or your company monthly.

The journey to 100 properties starts by helping just 1 seller.

Closing on your first property is often times much more than a simple “sign here” and you’re done transaction. If you’re already a successful investor you know closing on your first property (and subsequent next few dozen properties) is:

- Marketing

- Networking

- Advertising

- Connecting

- Building relationships

- Helping the community

- Helping sellers and buyers

- Repairing

- Outsourcing

- Screening

- Negotiating

- Following up

- Managing

- …and so many other ‘verbs’ you as an investor performs as an entrepreneur.

Mobile home investing to build towards a full-time business, or even to get started on your next few deals will require time per week (approx 20 hours) and dedication to know you the ins-and-outs of your local market and know how to serve it best.

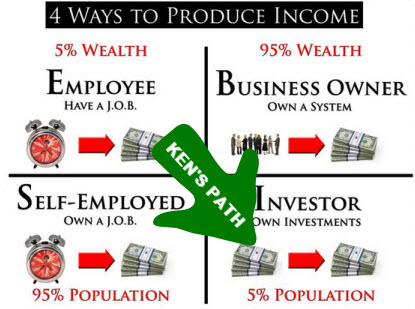

I am so proud of the real estate investor below on this video. Ken is now a full-time mobile home investor and has created the ability to invest in mobile homes full-time and quit his traditional 9-5 job. Ken has proved himself to everyone locally that he is here to help and here to stay. Please consider watching the full video below to not miss a thing. Ken tells all about what has been working and not working since his last interview.

Related: https://mobilehomeinvesting.net/mobile-home-blog/john-fedro-and-ken-guzan

Ken Guzman Case Study Mid-2014 – 5 Deals Down, 10 More To Go

What you may have learned:

- Build trust with local PMs. (Can be found at 1:35 of the video above)

- What is Ken’s goal for this year? (Can be found at 6:50 of the video above)

- Your secret to closing deals monthly. (Can be found at 9:40 of the video above)

- How long does it take to recoup your investment cost? (Can be found at 14:30 of the video above)

- How do you fill your funnel? (Can be found at 18:20 of the video above)

- Advice for new MH investors. (Can be found at 20:40 of the video above)

- What has surprised you with regards to the MHF? (Can be found at 24:00 of the video above)

- SlyDial’s phone number mentioned in the video is 267-759-3425

My hat is tipped to Ken and the other investors that have pushed themselves to take action to build something amazing in their local market or even nationwide.

If you ever have any mobile home investing related questions do not hesitate to direct them our way.

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

7 Responses

Way to go guys!! Very uplifting video. Awesome results Ken. John I noticed Ken is in FL. Is this business possible in the northern states like Ohio where I’m from?

Keep up the cool work man. I love seeing this stuff. Motivating stuff.

Cliff Mayor

Hi Cliff,

Thanks for commenting and for your kind words. Ken has earned all his success and I couldn’t be prouder. His consistent daily effort has made him a well known name in his market.

Concerning your question about the nationwide market versus FL. I’ve made a past posting that ranked the states by their mobile home population. Fl is ranked #17 out of the states and Ohio is ranked #38. In another article on this site I show how to find the number of local MHPs in your area. Once you know how many parks are nearby you can adjust your realistic opportunity to purchase/hold 6 MHs this year or over 12.

Hope this helps and makes sense.

Best and talk soon,

John Fedro

nice interview John. How do you comply with Dodd Frank regulations, etc. when selling on a rent to own basis. Are you really holding a mortgage on the mobile home? I assume that Ken in the video is not a licensed mortgage originator—how does he comply with the federal regs??

I like your site—lots of good info. Be well

Hi Ken,

Thanks for the kudos Ken! Good questions, it is so important to know these acts and rules as they are written and not written. No we are not holding a Mortgage on the mobile homes when selling. When we sell our mobile homes inside parks to end users we do not fall within the scope of the Dodd Frank acts or myriad of other seller financing acts. We held a past teleseminar on the subject in a past article-posting you should check out. Without going into great detail I hope this helps and makes sense.

Talk soon,

John

I am brand new at this and have a question for you all. I live in an area where there are hundreds of 55+ MHs for sale. Is it worth it to purchase one of these to move to a family park? What price range is reasonable to move it? Will the family park pay for or subsidize the move?

Any help is appreciated.

Hi Trent,

Thanks for reaching out and commenting. Please see my thoughts below. I have made my comments bold so they are easy to read.

I live in an area where there are hundreds of 55+ MHs for sale. Senior parks and homes can be profitable too if you 1.) have a verified buying demand from senior buyers locally 2.) know what buyers are paying for senior homes (all type of senior homes, sizes, # of bedrooms, repairs, monthly, cahs price, total down, etc) 3.) can purchase the homes for an even more conservative price or terms as a similar home in a family park. In short if you have many senior parks near you then it could very well be worth it to add senior parks to your investing turf, however you must be careful before buying and triple-check the resale numbers. Does this make sense? Is it worth it to purchase one of these to move to a family park? Yes, if the home fits your criteria and the new parks criteria then this could be a good idea. Keep in mind that after you remove the MH from the park the park manager will not be happy and will not want to work with you again or approve you for any more homes in their parks. What price range is reasonable to move it? I move only singlewides. This will depend on where you live in the country however between $2,000 and $6,000 with move, permits, and set up depending on the size of the home and additions/decks. Will the family park pay for or subsidize the move? Some will and some will not. So ask every park you can.

I hope this helps. If you have any more questions or I did not fully answer something let me know and we’ll get you cleared up on the issue.

Talk soon,

John