Welcome back,

In today’s article and video we’re going to discuss the popular question, “What happens if my tenant or tenant-buyer stops paying, damages my home, and leaves without notice?” This is a question we receive here often from eager prospective investors that are looking to fully understand the retaking and reselling of a used mobile home.

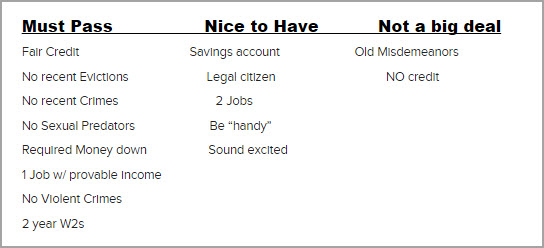

While this question is very valid, the real question is “How do I prevent a tenant or tenant-buyer from leaving my investment home damaged and/or without paying every month?” And the answer is… Help prevent these possible problems before they begin by prescreening, prescreening, prescreening your potential tenants and tenant-buyers.

You wouldn’t just hand over your car keys to a stranger. So don’t hand over your investment mobile home keys to anyone that you haven’t prescreened and approved. While approving and disapproving potential residents keep an eye out for…

Honesty: I like to say, “We grade on honesty as well as past-history.” An applicant who forgot to tell you any major criminal charge, debt, or issues with credit may not be trustworthy. I want to hear from the applicant about everything I should see in his or her background and credit check. I always repeat with, “Is that everything I should know?”

Credit Score: +600 is a good start. Most applicants are quick to tell you their story of what happened to them and why their credit beacon score may be so low.

Rental History: Look for tenants with good rental history. Anyone that has moved more than 5 times in the past five years may not be your best candidate for a long-term resident.

Eviction History: I like to see NO evictions within the last 7 years.

Foreclosures and Bankruptcies: Some people may be coming from a home they had owned, but due to hard times had to declare foreclosure or bankruptcy. Use your best judgment and their past history. One bankruptcy is acceptable if all else passes; however chronic bankruptcies does not make for great buyers.

Criminal History: Some criminal history is alright depending on the crime. No criminal history is ideal. Misdemeanors are better than felonies. Be prepared because most applicants will have a story for why it wasn’t my fault. I like to see that there are no recent offensives. Violent crimes and/or child predators are never allowed!

Job History: Job history should be steady. At least 1 provable job is recommended.

Income to monthly payment: Monthly household income should be 3 times the amount of the monthly payment, including lot rent. This amount should allow for other bills, water, food, insurance, and expenses monthly.

Personality Types: All approved applicants should sound and look excited to have this opportunity to Own.

Home Life: You may choose to surprise visit the potential buyer at their current home to view how they live. Are they pigs? You may have heard this before and it still works. Most investors/landlords never complete this extra step. These buyers will be treating your home similar to their current home.

Personal Automobile Condition: Note the type of car the potential buyer is driving. Is the buyer’s car clean inside? How about outside? This may show the buyers cleanliness habits without visiting their home.

Things that should raise red flags:

- The potential tenants are currently homeless and have nowhere to stay.

- The potential tenants have zero money saved.

- You see signs of drug use.

- When you interact with the potential tenants be aware of how they treat their children. Short tempered, loud, angry, and abusive are all good signs for a bad potential tenant.

- The potential tenants talk to you about their horrible ex-landlord, and how they trashed the place when they left.

- The potential tenants are in the middle of an eviction or bankruptcy.

TIP: It is infinitely better to have an empty mobile home than to approve a high-risk tenant. That sounds like common sense but when a Buyer or Tenant wants to sign papers with you and has their first payment plus deposit cash in hand you may have second thoughts. Be smart and have your wits about you – all prescreen.

A few words to the tenants reading this: Always make sure that you are happy and comfortable with the price, amount to Move-in, and monthly payments for your future home. If you are concerned about repairs always ask to check and verify for yourself prior to buying anything. Always keep in touch with your landlord or seller if there is any issue or concern.

Now that you (the investor) can help prevent this from happening…

What to do if my tenant, resident, or tenant-buyer stops paying me without notice?

Assuming that all the paperwork you use to rent or sell a mobile home allows you to evict the occupants inside, then your worst case scenario most times is only an eviction. This legal process of removing the occupants from the home can cost approximately $200-$600 depending on your state and county and should take less than 30-60 days to complete.

However, I have never met a person that has really wanted an eviction on their personal records. With that said if you use kind words, give a week or two of time, and perhaps a few hundred dollars to your tenant an eviction and any damages can be avoided. It is better to pay a tenant $300Always aim to have the residents leave on their own accord if a repayment plan is not arranged or followed through with. Make

TIP: It is better to pay a tenant $300 and have them leave in 2 weeks with the home clean, than to pay $600 to evict a tenant in 5 weeks and have them leave the home messy.

Repayment plans:

Payment plans can be helpful for tenants that have been with you for 12 months or more with a clean track record of payment. Bad things happen to go people and it is sometimes our job as investors to help our tenants and tenant-buyers if within reason.

Always aim to have the residents leave on their own accord if a repayment plan can not be arranged or followed through with. Only give a tenant 1 strike concerning a repayment plan. Make repayment-plan payments due weekly, this way if a payment is made it will be noticed in a week and not in 30 days.

TIP: When speaking to tenants that stop paying, always use appropriate tone. Do not talk down to anyone. This is no laughing matter, so be serious and speak clearly.

Low Risk: A low risk tenant or tenant-buyer is someone credit conscious that cares about their credit and their reputation. These folks do what they say they are going to do, or they alert you in advance of their error. Low risk tenants are easy to manage and follow the rules. If a payment will not be on time low risk tenants will call you quickly to notify you and figure out a payment arrangement. If they cannot stay due to finances they will also let you know they are moving out sometime soon.

High Risk: A high risk tenant or tenant-buyer is someone that is not credit conscious. Many high risk tenants have a history of moving from one place to another quickly. High risk folks tend to think only of their situation, lie, dodge phone calls, miss appointments, make excuses, have many bills in collections, etc. It is easy to be fooled or manipulated by high risk occupants so follow your gut and the background/credit check you perform on each adult in the home.

If a tenant or tenant-buyer has been on-time with monthly payments for 12 months or more I am easier to give extension to help this tenant get back on their feet.

TIP: A general rule is once an occupant starts slipping with their monthly payments and/or asking for extensions to pay, it is countdown to when the occupant says they need to leave as they can’t afford the payments anymore.

Has this situation just happened to you?

If you have found this page because a tenant or tenant-buyer just left your investment mobile home damaged and without paying, then listen up cause here’s what you’ll want to do…

- If the tenants are still in the home try to happily and quickly get them to leave.

- If there is already severe damage file a police report.

- Evict the occupants if still in the home and not paying.

- Take legal action to be compensated for damages.

- Next, quickly clean and fix the home to remarket.

- Understand why this happened to you and your tenant? Understand how to avoid this situation in the future.

- Resell or re-rent.

Emotions lead to damages.

If a tenant or tenant-buyer damages your home after or during their leaving process it is important to remember that this person is likely very mad at you and mad at the situation, and they feel wronged. It is our job as investors to be crystal-clear when signing, reading, and negotiating all prices and terms. Happy tenants generally don’t damage homes. If a resident feels pleased with you then they will not feel the need to damage your property to get the pay back they feel they are owed. Low risk occupants with a clear track-record have a much lower rate of damaging homes compared to high risk residents.

Conclusion: In conclusion everyone ideally starts off a seller/buyer or landlord/tenant relationship with the plan to do just what they say they are going to do. For many reasons a resident may slip behind and be unable to pay. If the resident is a high-quality person they will admit they can’t stay as agreed and leave. If the resident is a low-quality person and/or if they feel tricked or cheated then the resident may be unhappy and do things an unhappy, emotional tenant will do.

Always aim to fill your homes with low-risk buyers or renters with good histories. Do what you say you are going to do as an investor and only sell Win-Win attractively priced mobile homes to buyers and renters.

I hope this article makes sense and provides help with this question.

If you’ve had a similar or different experience good or bad please comment it below and let us know.

Love what you do daily,

John Fedro

Related videos:

10 Responses

Hi John,

This posting sure rings true for me. Been there before and done that. I have sold to rejects and saints and I have to tell you I would much rather deal with saints for the rest of my life. Very good comprehensive article. The only thing I would add is to be aware of younger folks in general while renting or selling, they always seem to be the highest risk.

thanks,

Kurt

Hi Kurt,

Thanks for reaching out and the kind words. Ultimately the people we sell to and agree to have live in our investment homes is our decision as investors. We much learn from every mistake we make and from the mistakes of others. I agree with you that folks under 30 years old are typically more prone to be flakey and fly-the-coup without a notice however I will also state that these same 20 somethings grow up to be senior citizens with some of the same flakey values. All in all have both eyes wide open when it comes to filling your properties. If you have any specific questions don’t hesitate to reach back out Kurt.

Talk soon,

John

John- great article! You brought up an interesting point under the red flag section as it regards to tenant being disrespectful toward his or her children. I had a family look at one of my MH who end up purchasing it from me. Everything checked out and according to your checklist they fell under the low risk category with the exception of the mother demonstrating short temper with her adult son. Turns out, they had a big disagreement shortly after they moved in and the son and his wife later moved out! So I totally agree with your statement; spot on!! Thanks for great article.

Hi Shevaughn,

Thanks for commenting and sharing your story. I had to smile as I read this because this situation has happened to me as well a few times. It is for this reason I keep advertising my homes for sale until I have money in my hand and paperwork signed by my buyer.

Talk soon,

John

Great Post! I like to think I do a good job prescreening but every time I let something slide I end up paying for it big! Thanks for the reminder

Hi Michael,

Glad to hear that potential risky renters are not getting into your places. I have seen too many investors be fooled and lose money by letter the wrong folks into their properties. So many headaches and problems vanish when low-risk tenants or tenant-buyers are found versus more risky folks. Keep up the good work.

Talk soon,

John

Hi Michael,

Sure thing. What is your question about MHs on land? Is this about your own property? If I can help answer it I will certainly try to help.

Talk soon,

John