Is Mobile Home Investing Right For You?

Free Mini-Course For Mobile Home Investors

Instant access to multiple lessons teaching you how to safely make money with mobile homes. You’ll learn sizes and features, setting seller expectations, who you’ll help, identifying and inspecting mobile homes. Join below…

WILL YOU BE OUR NEXT MOBILE HOME INVESTOR SUCCESS STORY?

The original mobile home investor training website. Learn from the 1000’s of mobile home investors that got started right here. Gain financial independence through individual mobile home wholesales, fix & flips, and mobile home note investing.

Hi, I’m John Fedro. I’m a 43-year-old guy from central Florida, now living in central Texas, who makes a living investing in individual mobile homes and mobile home parks.

This website library is my attempt to help others avoid the mobile home investing mistakes I’ve made. Plus help you quickly learn how to predictably make more money with mobile homes.

Mobile home investing is a people-business. As mobile home investors we invest in the mobile homes, but we help real human beings. Even after hundreds of deals closed and thousands of successful mobile homes investor deals across the nation, I still love meeting new people daily.

Today I spend much of my time growing my individual mobile home and mobile home park portfolio, including wholesaling, flipping, and cash-flowing mobile homes and parks nationwide. Most extra free time is dedicated to helping Mobile Home Formula investor/partners nationwide learn and grow their own mobile home flipping and cash-flow business.

I’d like to show you what I’ve learned mobile home investing.

You don't need another course. You need a system and a mentor.

Here's how we're helping sellers & making our money safely...

- Wholesale for faster profit: Wholesale mobile homes inside parks, with land, or that must-be-moved. Every investor will find many mobile homes he/she can’t or won’t purchase, wholesale it instead. Learn local prices and help sellers. This technique requires little to no money or no credit.

- Fixing & Flipping for All-Cash. Classic! Purchase, make pretty, and resell for a payday. This applies to all mobile homes on land or inside parks. Aim to profit double (2x+) your invested capital. There are more cash buyers today than ever before.

- Selling mobile homes for monthly payments. Passive long-term wealth. Learn to create Notes selling for cash down and monthly payments 5 to 30 years from your low-risk buyers. Sell your investment mobile home in a park and/or on private land you own.

- Using Option agreements for multiple properties at once. Use Option agrees made specifically for personal property to secure and control multiple mobile homes at once for resale. Using little capital to control. This technique requires little to no money or no credit.

- Outsourcing repairs immediately: Your best use of time is making deals and growing your business. Learn to find, screen, hire, manage, and build a SAFE team of skilled craftsmen to repair your mobile home investments.

- Moving mobile homes into nearby parks for win-win deals. Adding mobile homes to vacant lots inside local mobile home parks is Win-Win-Win for everyone. Ask to have the mobile home parks pay for all your mobile home transportation costs.

- Adding mobile homes to land you own for cash or cash-flow. Over 70% of all mobile homes can be found outside of mobile home parks. This is private land you may also purchase and own. Also, learn to add inexpensive mobile homes to vacant land you find and purchase for cheap.

- Out-of-state investing for safe deals too far to drive. Investing remotely from behind your computer is possible with a proven plan, proper due diligence, and a trusted TEAM near the subject mobile home.

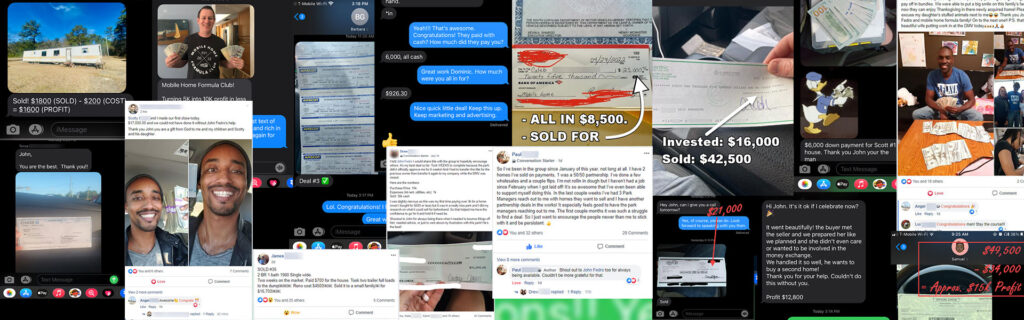

Mobile Home Investing Success Stories

Success Stories

Mobile Home Investing is Already Proven!

Here's Your Game Plan...

- Begin Wholesaling & Flipping to build up your cash reserves.

- Next, start selling some mobile homes long-term for monthly passive cash-flow for the next 5-30 years.

- Scale your mobile home business by outsourcing, automating, and aiming for multiple-home deals.