Welcome back,

In today’s article and video, we are talking all about mobile home insurance. Mobile home insurance is usually not an exciting topic for most real estate investors. However, the content below will do its best to logically, objectively, and thoroughly discuss many of the most important ins-and-outs with regards to insurance and mobile homes. In the article and video below we cover insurance related to your…

✔ Mobile homes located on private land.

✔ Mobile homes located inside pre-existing mobile home communities.

✔ Mobile homes you own for investment properties.

✔ Mobile homes you own for your personal residence.

In today’s article and video we will also be covering…

✔ Examples when insurance was and was not used correctly.

✔ Common errors investors and owner-occupants make obtaining and holding insurance.

✔ Terminology and vocabulary you may hear.

✔ Common, unorthodox, and specific insurance questions you may have moving forward.

✔ If property insurance is always needed and/or wise in every situation?

✔ Alternatives to mobile home insurance when buying, holding, fixing, renting, and/or reselling?

Let’s just jump into it.

Common mobile home insurance terminology and vocabulary

✔ Homeowner’s policy/insurance: This insurance is for homeowners personally living in their properties. If your name is on the title, SOL, and/or deed you are the homeowner. In some states only a Bill of Sale is needed to show ownership depending on the home and age, in these situations this Bill of Sale constitutes ownership. This type of insurance includes 1.) liability coverage, 2.) personal property/contents coverage, and 3.) property/dwelling coverage (see below).

✔ Landlord policy/insurance: This policy is for homeowners not personally living in their properties, but rather renting them out to any tenants or friends. This type of insurance includes 1.) liability coverage and 2.) property coverage. However not typically included is personal property coverage due to the fact the home is being rented unfurnished in many cases. A small amount of personal property coverage may be added (by you) to protect against a refrigerator, washer/dryer, etc theft or total loss due to the home being destroyed. Tip: Be cautious when renting to friends or family. These folks often times know you best and sometimes feel they can get away with more than other people can. Additionally, it may be harder emotionally to evict or demand back rent from these types of tenants.

✔ Renter’s policy/insurance: This policy is for renters that are currently renting a dwelling of any kind. Renter’s insurance is often required by many landlords and apartments nationwide before a renter moves into a dwelling. Renter’s insurance includes 1.) personal property/contents coverage and 2.) liability coverage (see below).

✔ Vacant policy/insurance: This policy is for homeowners/investors that have a property that is currently vacant. This property may or may not be having repairs currently made to it. This type of insurance typically includes property coverage and liability coverage. This type of insurance may typically be more expensive than homeowner’s insurance.

✔ Hazard insurance: This is a general term to describe protection from hazards due to fire, vandalism, smoke, and other causes. Hazard insurance can be another name for property insurance (see below).

✔ Condo insurance: This insurance is for condo owners. This insurance typically covers the interior of your condo, however not the exterior. The exterior insurance cost may typically be included in your condo association fees and provided by the Condo association.

✔ Mobile home insurance: This insurance is for mobile home owners. Depending on whether your property is a rental or your primary residence, it may or may not include personal property coverage of your contents inside of your mobile home.

✔ Coverage amount: This is the maximum amount of money the insurance company will pay out for various items relating to your insurance policy. For instance, if the entire home is destroyed, the insurance company may pay out your maximum coverage amount. Example: $100,000 for the home itself and $50,000 for the personal property, your contents and possessions, that were inside the home at the time. The higher the coverage amount your home and contents are protected to, typically correlates with a higher yearly insurance premium.

✔ Insurance binder: This is a general term referred to the entire set of papers and agreements you will sign and send back to the insurance company with your first payment to start coverage.

✔ Insurance premium: This is your total yearly payment amount for yearly insurance coverage. If you do not pay your insurance premium, then the insurance will lapse and be considered void. At this moment your property will not be covered.

✔ Declaration page: This is typically the first and/or second page of your insurance binder. The declaration page usually describes the coverage amount, deductibles, what is included, home address, and other pertinent facts about the coverage.

✔ Deductibles: This is the amount you will have to pay out-of-pocket before the insurance starts to pay for damages. Deductibles usually apply per yearly policy, and not per claim. Example: If you have a $1000 deductible, this $1000 will need to be paid just once even if you make 3 different expensive claims over the year. Typically, the higher the deductible the lower your insurance premium may cost.

✔ Liability coverage: Liability coverage is contained in most homeowners’ policies, landlord policies, and vacant home policies. This term refers to insurances that covers lawsuits against you for injuries to other people (called Bodily coverage) or damages to other people’s property (called property coverage) that you, your family, or your home’s debris cause. The coverage amounts and deductibles may likely be set by you unless borrowing money from a bank, in which case the bank may dictate the limits and deductibles needed. There are situations where certain condo boards and/or homeowners’ associations have minimum deductibles and coverage amounts.

✔ Contents or personal property coverage: This term refers to the aspect of insurance that covers your personal possessions inside of the dwelling you live. In many areas personal property coverage is typically set at 50% of the property coverage amount, unless renting. Example: In a homeowner’s policy, if the entire home is covered to $100,000, than the possession inside is typically set at $50,000. In many cases you may adjust this if your contents are worth more or less than the suggested covered amount.

✔ Umbrella policy/insurance: This type of insurance is extra liability insurance. This type of insurance policy is designed to help protect you from major claims and lawsuits. An umbrella policy may be purchased over and above all your other insurance policies. Example: You may have a $5 million umbrella policy in caution of being sued.

✔ Force-placed or Forced insurance: This is the term for insurance placed on your home by your bank or lender if you do not pay your current insurance bill and your insurance lapses and becomes void. If you are borrowing money from a bank or lender they will typically be listed as Mortgagee on your insurance policy. They will also be alerted immediately if the policy is not paid for on-time. Since the bank or lender does not want to risk losing their money in the event the home is destroyed, they will pay for an insurance policy on your property and charge you for this amount plus an added penalty fee in most cases. All of this is typically agreed to in your loan/mortgage paperwork. Tip: Pay your insurance bill on time.

✔ Monthly escrow for insurance: Some banks and lenders will escrow monthly for insurance. This means they will collect a certain amount of money from you every month in addition to your loan payment. This extra money goes to pay for your yearly insurance premium to keep everything current and up-to-date. Example: If the bank knows your insurance premium cost $1200 a year, the bank will automatically collect an extra $100 from you monthly on top of your loan payment to be placed in a separate account to pay the insurance premium the following year.

✔ Home warranties (Not home insurance): A home warranty is not a traditional insurance policy. A home warranty may be purchased from a third-party home warranty company that offers to fix or replace broken mechanical systems and appliances inside your home when they fail. A yearly premium is collected at the start of the policy, and a deductible (typically less than $100 in most areas) will be collected whenever there is a service call to fix or replace an appliance or mechanical system within your home. Appliances that fail from normal wear and tear are typically covered in this type of policy, however something that could have been avoided due to negligence may not be covered. Tip: Home warranties may be transferred to new buyers in most cases. This may be an added benefit and value to most of your end-buyers if you are selling your investment mobile home for cash or payments.

✔ Riders or Endorsements: This is a term for any addition to your insurance policy. Riders and endorsements typically, but not always, come at the end of your policy. These may include provisions for flood insurance, sinkhole coverage, wind coverage, extra coverage, tornado coverage, hail coverage, Loss of income (see below) and more. Keep in mind that not all/any endorsements are needed in every area.

✔ Exclusions: This is a term for any type of coverage that is not included in your policy. Typically a specific section of your insurance quote and binder will list all exclusions not covered in this specific policy.

✔ Builder’s risk policy/insurance: This type of insurance is for builders/investors rehabbing a vacant property. This type of insurance typically covers the structure of the property itself as well as materials, fixtures, and equipment being used in the construction and renovation process.

✔ Loss of income insurance or Fair rental value: This policy coverage protects you in the event your rental property cannot be rented due to serious damages and repairs needing to be made. You will receive money as if your property is rented even though your tenants have left due to the home being uninhabitable for some reason. If the damages are due to negligence or are not covered in your policy than the repairs and loss of income protection may not apply to these types of damages.

✔ Flood insurance: Flood insurance protects from damages due to flooding. Flood insurance may not be covered in most policies but may be purchased separately through your insurance agent, or through state or nationwide insurance companies.

✔ Replacement cost: This term refers to the cost to rebuild a new home to similar specifications in today’s money. This is preferred to the Actual cost.

✔ Actual cost: This term refers to the cost to rebuild the property minus the depreciation over the years the home has been in existence.

✔ Covered peril: This is a general term for damages or loss due to major peril such as fires, wind storms, floods, or theft.

✔ Wear and tear: This is the general term to describe the normal and expected deterioration to a home or object over time. Damages due to wear and tear are typically not included in most insurance policies.

✔ Preventable repairs: This term is similar to neglect. Preventable repairs are typically not covered in most insurance policies. Typically, the person that will deem if the repair was “preventable” will be the insurance adjuster or licensed contractor that is hired by the insurance company once your claim has been filed.

✔ Claim: This is the formal request to an insurance company for coverage or compensation in the event of loss or damages.

✔ Additionally insured: Typically, a mobile home park (if the park asks for insurance) or your landlord (if you’re renting and have a renter’s insurance policy). This is the term, and section of the policy, for the party or parties that have an interest in the home or dwelling. The additionally insured parties may not be paid in the event of damages or loss (check with your agent).

✔ Mortgagee: Typically, the lender, lien holder, and/or bank. This is the term, and section of the policy, for the party or parties that are likely owed money from the homeowner. The mortgagee listed on the policy will be paid in the event of damages or loss.

✔ Real property: This is the general term referred to real estate. A mobile home is considered real property when it has been legally married/joined to a parcel of land also typically owned by the mobile home owner. Mobile homes considered real property are not taxed as personal property. Instead the land and home are joined together and taxed as one property.

✔ Personal property: There are 2 typical meanings in real estate: 1.) Referring to someone’s personal items and/or contents inside his or her home. or 2.) This is the general term given to personal property. A mobile home located inside a pre-existing mobile home park is typically personal property. A car, boat, coin collection, etc. are also personal property as well. A mobile home legally sitting on top of a parcel of land also owned by the mobile home owner may still be considered personal property. Typically, by contacting the local tax assessor’s office and property appraiser’s office will a homeowner be able to legally marry/join their mobile home and parcel of land together. In some states when transferring from personal property to real property designation, the mobile home title is relinquished to the state as the title(s) is no longer needed because the property will then be considered real property. Once successfully married together, the legal description of the land may be updated to include the mobile homes VINs or serial numbers.

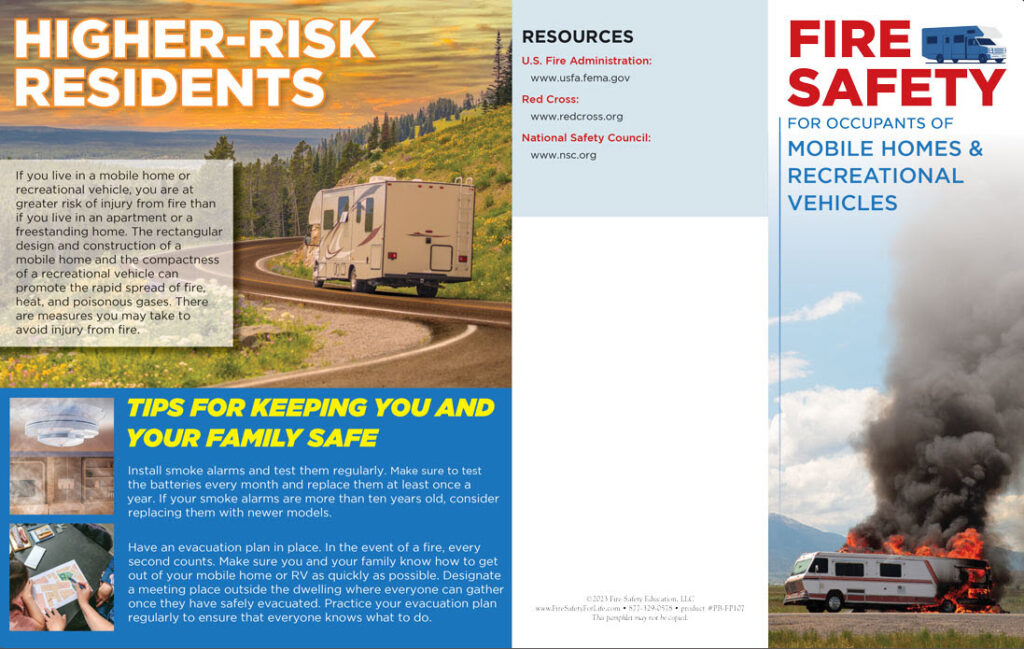

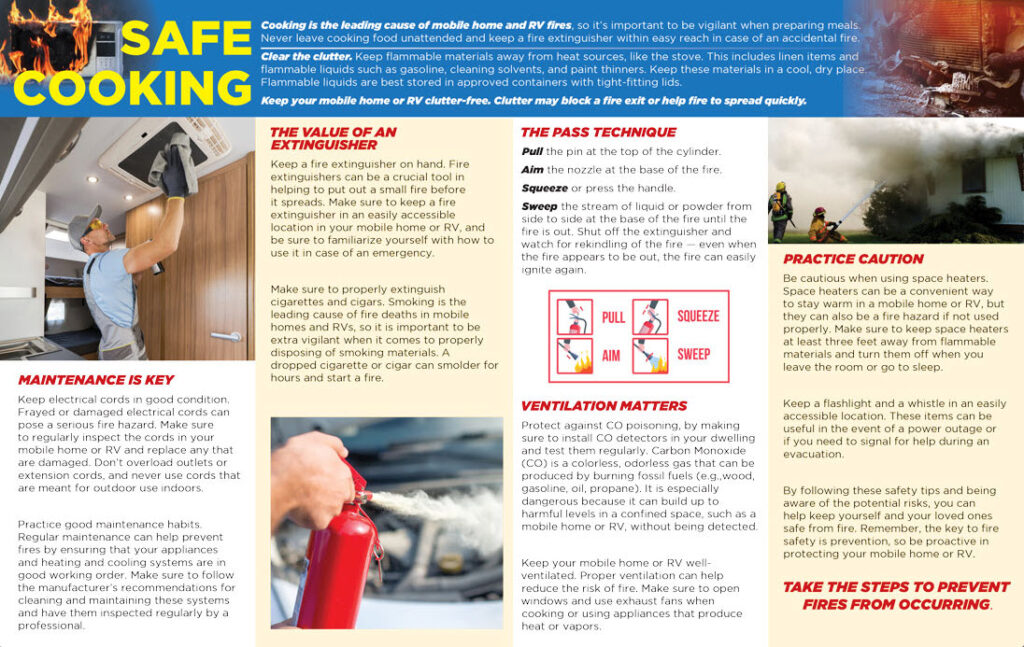

- Smoke Alarms: Install smoke alarms on every level of your home, inside bedrooms, and outside sleeping areas. Test them monthly and replace batteries as needed.

- Fire Escape Plan:

- 🔥Create a fire escape plan for your family. Include two ways out of every room.

- 🔥Designate a meeting spot outside your home, away from danger.

- 🔥Consider placing a decal in your front window indicating the number and type of pets you have.

- Space Heaters and Heating Equipment:

- 🔥Keep space heaters at least three feet away from flammable materials like paper, bedding, and furniture.

- 🔥Place space heaters on a nonflammable surface (e.g., ceramic tile) and never on rugs or carpets.

- 🔥Plug power cords directly into outlets, avoiding extension cords.

- Fireplace Safety:

- 🔥Never leave a fire in the fireplace unattended.

- 🔥Use a glass or metal fire screen to keep embers contained.

- Cooking Safety:

- 🔥Keep dish towels, oven mitts, and clothing away from stovetop flames.

- 🔥Never use a cooking range or oven to heat your home.

- Electrical Safety:

- 🔥Avoid overloading circuits and electrical outlets.

- 🔥Regularly inspect electrical systems and appliances.

- 🔥Turn off portable space heaters when not in use.

- Generator Safety:

- 🔥If using a generator, understand the risks of carbon monoxide poisoning.

- 🔥Place generators outdoors and away from windows and doors.

- Power Outage Preparedness:

- 🔥Use flashlights instead of candles during power outages.

- 🔥Keep refrigerator and freezer doors closed to preserve food.

- 🔥Turn off unnecessary electrical equipment and appliances.

- Fire Extinguishers:

- 🔥Have fire extinguishers readily available and know how to use them.

- Safe Cooking Habits:

- 🔥Never leave cooking unattended.

- 🔥Keep flammable items away from the stove.

- Electrical Cords and Outlets:

- 🔥Avoid overloading outlets and extension cords.

- 🔥Plug power cords directly into outlets.

- Heating System Maintenance:

- 🔥Have your cooling/heating system professionally inspected regularly.

- Emergency Preparedness:

- 🔥Know how to report downed power lines and use flashlights during outages.

- 🔥Prepare a cooler with ice for freezer items during prolonged power loss.

- Unplug Unnecessary Electronics:

- 🔥Turn off and unplug sensitive electronics during power outages.

- Stay Informed and Practice Safety:

- 🔥Regularly review fire safety measures with your family.

- 🔥Practice your fire escape plan at least twice a year.

Common, and not-so-common, insurance questions

✔ How much coverage is needed for my property? When obtaining insurance coverage your agents may suggest to you how much your property seems to be worth based on the records or information they have online. If you owe money on the property it may be very wise to have coverage for at least this current loan amount. Additionally, it may be wise to increase your coverage limit so that a new comparable home may be purchased if the current one is completely destroyed.

✔ May I over-insure my property? Yes, however only to a certain “reasonable” extent. While it may be easily possible to over insure your property by 20%-30% of the value, it may look very suspicious if you try to increase the coverage limit by 50% or 100%+ the home’s replacement value. Insurance companies view this as suspicious and will typically not be allowed. However if just-cause can be shown as to why the home is worth this amount, then the increased coverage limit may be approved.

✔ May I under-insure my property? It depends. If there is a bank loan on the property the lender will typically require the property be covered to a limit that protects the lender’s capital. However, if there is no bank loan and the home is owned free-and-clear than the home may be under-insured to the homeowner’s liking. Keep in mind that any payout will have a maximum of your coverage limit.

✔ May I take out multiple insurance policies on one property? Yes, however this will look suspicious and will not pay you out any more money in the event of a total loss. Insurance companies talk to one another and if you are insured with five different companies for $100,000, then each company will likely payout $20,000 in the event of a total loss. In the example above, if you were to somehow receive $500,000 total from these five companies, this would be fraud and very illegal. Owners are not supposed to make a profit with insurance. Insurance is ideally to help protect against losses and lawsuits.

✔ Is working with a big insurance agency or little insurance agent better? Whether you call a small mom-and-pop insurance agent in a small rural town or a large insurance outfit, the agent that answers the phone will likely be a salesperson for one or multiple major insurance companies licensed to do business in your state. A single agent may have access to multiple insurance products or may only represent a single insurance carrier. Tip: A more experienced agent may be able to educate you more for your exact situation. However, aim to find an agent that makes you feel comfortable, spends time with you, answers your questions, and provides you with the highest quality, best coverage, and lowest prices available. Do not work with anyone you feel is pushy or aggressive.

✔ How do I make or file a claim? Start either by calling your insurance agent directly or the Claim phone number listed on your insurance binder. This will start the process and you will then be given further instructions to complete.

✔ How long after I make a claim will I get paid? Once an insurance adjuster approves the damages and gives you a total of how much the insurance company will pay, funds may usually deposit or be wired into your bank account within days.

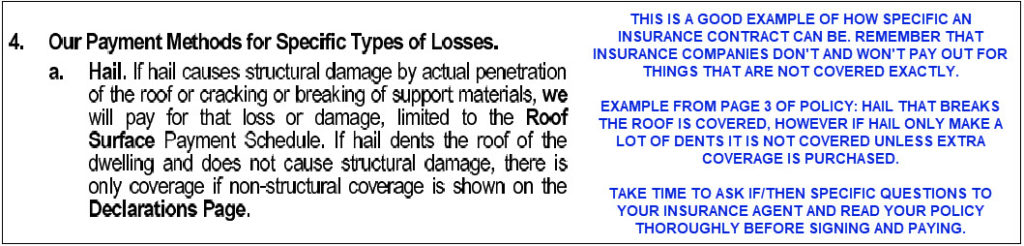

✔ What is covered in my policy? Very good question…It depends. If you currently have an insurance policy find your insurance binder and read through everything you can. This may not be a very exciting to read however you may learn a lot about what is and is not covered in your specific home policy. Ask your agent any questions or doubts you have. If you do not currently have an insurance policy than spend time writing down all the scenarios you want to make sure you are protected against. These will be great questions and a great outline for an insurance agent to follow. Keep in mind that some items may or may not be able to be insured. However, it is typically better to have more clarity than less clarity, so ask more questions than fewer.

✔ Can my insurance company deny my claim? Yes, if the damages are due to negligence or wear and tear the claim will most likely be denied. If the policy is the incorrect type of policy this may void the claim as well. Additionally, if the damages are due to something you are not covered for, the insurance company will not pay out on this claim. It is important to remember that your insurance company does not want to pay if it does not have to pay. It is only going to pay for things covered in your specific insurance policy agreement.

✔ How much does insurance typically cost? Great question. Call around to at least five separate insurance carriers and/or insurance agents in your state. Depending on your insurance company, property type, property value, coverage amounts, deductibles, exclusions, riders, locations and more, the cost of your insurance will greatly vary. Again, call at least five separate insurance companies to judge prices and coverages for your specific needs and property.

✔ Can I be denied coverage for my home? Yes, however this does not often happen. In most cases there is a policy for most mobile homes. In some cases your older mobile home may need to successfully pass a four-point inspection from a third-party contractor or inspector the insurance company hires. This four-point inspection includes inspecting your property’s roof, electrical systems, plumbing, and HVAC (heating, ventilation, and air conditioning) to make certain each part is in safe and working order.

✔ Does a better credit score equal a lower insurance premium? It depends. Some companies use credit to help determine you as a risk factor. However, some companies will never need to know your Social Security number. In some states this credit-based insurance practice is illegal. Ask your insurance agent to know for sure. Tip: If your insurance agent is planning on running your credit to determine your insurance premium, ask that they give you a rough estimate of your premium before pulling your credit. It may not be wise to have insurance agents pulling and dinging your credit multiple times to give you various quotes from various companies.

✔ If I have made previous claims on my insurance can this be held against me in the future? It depends, in some cases yes. Certain types of previous claims may cause your future rates to increase.

✔ Are discounts typically available? It depends. Ask each insurance agent you talk with to know for sure. Discounts may include, but are definitely not limited to: you being a real estate professional or Realtor, military member, bundling your property insurance with your car or health insurance, having a monitored security system, being a very short distance from a fire hydrant, being a non-smoker, being retired, paying the total insurance premium upfront, etc.

✔ Can the insurance be in the name of my company, land trust, or personal property trust? Typically, yes. Be very upfront and honest with the exact situation and goal for each specific property you insure. If the insurance ends up in the wrong name the insurance company may not pay out in the event of loss or damages.

✔ Do I have to pay my yearly insurance premium upfront in-full or may I make monthly payments? It depends. If a bank is involved typically the bank will want to see the first year’s insurance premium paid in full before closing and owning the property. However if there is no bank demanding insurance is paid in-full upfront, then a monthly payment or quarterly payment plan may be arranged with the insurance company.

✔ How do I find local mobile home insurance companies around me? There are nationwide companies to choose from as well as specific state-based insurance companies that work solely within your state. Perform an Internet search for “mobile home insurance companies in [my state or city]”. In addition to performing this search also try getting quotes through agents from Allstate, Foremost, State Farm, Liberty Mutual, Farmers, and USAA (for military members).

✔ What happens if my mobile home, condo, or traditional home is destroyed or damaged without insurance? In many cases you are responsible for everything moving forward. If there are simply basic repairs needed than all these repairs will have to be paid for by you, or the repairs will simply not be made. In the event of a total loss the home may have to be cleared away and replaced, or the land/home sold as-is. Mobile homes inside a pre-existing park: In the event of a mobile home inside of a pre-existing park being totally destroyed, the person on the park’s lease agreement will typically still be responsible for monthly lot rent fee until the home is cleared off the property/lot and a vacant and clean pad can be given back to the park. Look for this specifically in your park’s lease agreement, rules and regulations agreement, or prospectus. Demolishing and removing a destroyed mobile home may take days or weeks depending on the condition, and may cost $2000-$5000 or more depending on who you use.

✔ Do I have to make repairs with the insurance money I receive from a claim: If there is no bank loan and the insurance proceeds go directly to you, then no. This money is typically deposited into your bank account or made by check without any strings attached. However make sure you know your realistic exit-strategy for this home now in need of repairs.

Owner-Occupants: Know your options as a mobile home owners. (Not for investors. Investors see the orange section below.)

This short section of the article is for end-users that will be living in their properties as personal residences.

When will I absolutely need property insurance as a homeowner or renter?

In some ownership situations you may not have the choice whether to obtain insurance on your property and possessions. These situations include, but are not limited to…

✔ When buying with bank financing: When buying through a conventional lender, bank, or credit union, the institution will typically require specific insurance and coverage limits prior to funding your mobile home in a park or on private land you also own.

✔ When buying and paying cash: If you are able to pay for your mobile home in cash than the decision to insure the property likely falls 100% on you. However, if you want to be 100% confident you are protected for certain repairs, catastrophic losses, and injuries to others than obtaining property insurance may be a very prudent idea. Inside parks: Only a minority of mobile home parks require all residents to have insurance up to certain coverage limits to protect others in the park from damages and flying debris. Your park manager should have alerted you prior to purchasing your home in a park.

✔ When owning free and clear: When you want to make certain you are 100% protected against specific damages, injuries, and/or catastrophes.

✔ When you’re a renter: Many apartment companies and traditional landlords will require a renter’s insurance policy with minimum coverages of personal property (your possessions) and liability coverage (harm against others) before renting and moving into your new rental property.

When should I strongly consider having property insurance as a homeowner or renter?

In some ownership situations you may have the choice whether to obtain insurance or not on your property and possessions. These situations include, but are not limited to…

✔ When renting: Some apartment companies or traditional landlords may forget, omit, or not require you to obtain a renter’s insurance policy. While this may save you some initial money by not charging you an insurance premium, you will have no protection in the event your personal items are stolen or damaged. You will also not be protected in the event somebody hurts themselves in your rental property due to your negligence and sues you. If you are unsure about obtaining renter’s insurance, call a few insurance companies/agents to see how affordable yearly rental insurance coverage can be. It’s free to call and ask questions.

✔ Other times: Always consider having property insurance on your primary residence. If you are unsure about obtaining property insurance, call at least a few separate insurance companies and speak with agents to ask questions, determine the best policy for you, and understand your costs and risks. It’s free to call and ask questions.

What situations may I not want property insurance as a home owner or renter?

✔ If no one is requiring you to have your own insurance policy, then you are in control. Skipping insurance is placing all risk-of-loss on your shoulders. For most owner-occupants your primary home is potentially your largest possession of value. As an owner-occupant living in your primary home you may always want to have it protected against catastrophic loss, certain repairs, and injuries to others. Some people may say that they cannot afford insurance, however the risk of damages, losses, or being sued can greatly outweigh the cost of your yearly insurance premium.

What to do next as a mobile home owner?

Do your homework and research. Whether you currently have insurance and are looking for better rates, or getting your ducks in a row for future properties, call up 5 separate insurance companies to speak with various agents to compare pros and cons of each company.

Before calling these companies write down a list of important situations you fear happening to your property and possessions. Think of different if/then scenarios, fears, and write down any questions big or small to ask these insurance agents.

When a policy is created for you, it will then be emailed or faxed for your review, signature, and payment. Use a highlighter to highlight any confusions and questions you wish to ask your insurance agent before proceeding. The only bad/silly questions are the ones you still do not ask. Having more clarity is better than less clarity.

Investors: Know your options as a mobile home investor. (Not for owner-occupants. Owner-occupants see green section above.)

Moving forward as an active mobile home investor it almost always better to have more clarity in your deals than less clarity. This includes whether or not you should/will obtain insurance on your properties before, during, or after purchase, fixing, selling or sold. The time to consider all of your options is well before you purchase a property or even make any offers to purchase an investment property. With that said if you currently own a piece of real estate or personal property that is not insured, you may usually obtain insurance if desired starting now and moving forward.

When will I absolutely need property insurance as an investor?

In some situations you may not have a choice when it comes to obtaining insurance on your property. These situations include, but are not limited to…

✔ (Purchase strategy) When buying with a conventional loan: When obtaining a traditional or conventional bank loan, hard-money loan, lien, or mortgage on your property, verbiage is written into most traditional loan agreements that the borrower agrees to maintain adequate property insurance while the lender is still owed money. If insurance is not initially obtained the bank loan will typically not be funded. Additionally, if the insurance lapses because of nonpayment the bank will likely issue force-placed insurance on the property and add this to the borrower’s monthly note payment. Tip: When borrowing from a lender, the lender will usually be listed as mortgagee.

✔ (Purchase strategy) When buying real property subject to an underlying loan(s): When purchasing a mobile home, condo, or traditional home with the purchase strategy known as “purchasing subject to the underlying loan” you will leave the original borrower’s loan in place while the deed is transferred into your control. Option 1:

In situations like this you (the investor) may wish to cancel the current homeowner’s policy (and keep the proceeds) and purchase a new landlord policy with the bank named as mortgagee, and the seller listed on the policy as additionally insured. Some investors do not wish to obtain a new landlord policy in fear of alerting the bank of the deed transfer. In this case the investor will not be protected in the event of total loss. Option 2: (Less ideal) Some investors have the seller change the current homeowner’s policy to a landlord policy, and name the investor as additionally insured on the policy. This will protect the bank and seller, however will not protect you in case of total loss, as the checks will not come to you in case of significant loss.

✔ (Purchase strategy) When buying & owning free and clear: When purchasing for all cash you have the choice to insure or not. If you wish to make certain you are 100% protected against certain damages, injuries, lawsuits, and/or catastrophes. Tip: In situations like this no one will be listed as mortgagee or additionally insured.

When should I strongly consider having property insurance as an investor?

In some ownership situations you may have the choice whether to obtain insurance or not on your properties. These situations include, but are not limited to…

✔ (Purchase strategy) When buying with a family loan or OPM: When you are borrowing money against a property, however the lender is your family, friend, or an inexperienced money-lender that does not demand or forgets to demand that you hold insurance. If you owe money to somebody that is helping you buy, protect yourself and protect your lender by obtaining property insurance with enough coverage to pay back the lender in case of a total loss. Tip: In situations like this the lender will be listed as mortgagee.

✔ (Purchase strategy) When buying & owning free and clear (if vacant, being repaired, or renting): Even though no bank or person is demanding you obtain insurance, no one can see or predict the future. Insurance does cost a bit of money however can save your business, career, and home from serious damage/injuries on your property, lawsuits, and catastrophic loss.

✔ (Exit strategy) When selling via a Lease option program, Rent credit program, or Land contract method: While “selling” via lease-option type of program, rent credit type of program, or land contract you will still be the owner until the title or deed has transferred into the new buyer’s name in the distant future. In these types of contracts, the transfer of ownership typically happens at the end of the contract/agreement when the buyer has finally paid all of the money owed to you. This means that almost all damages, injuries, and losses fall on your shoulders in many cases. Tip: In these situations, a Landlord insurance policy will typically be desired by you. It may also be wise to request your renters/tenant-buyers carry Renter’s insurance with at least $100,000 liability coverage and some content coverage to protect them and you moving forward. Tip: Requiring your renters/tenant-buyers to obtain insurance can be an additional way to prescreen your tenant-buyers.

✔ (Exit strategy) When selling via owner financing: While selling via owner financing, typically 100% of the ownership interest is transferred to your buyer(s) upfront at the time of closing. This means that you’re mainly acting as the bank. Tip: In these situations, you may wish to require your buyer(s) obtain a Homeowner’s insurance policy with you listed as mortgagee. As mortgagee you will be alerted to this coverage. The mortgagee will also be alerted if the insurance lapses or the buyer fails to pay for their insurance policy. As the bank you’ll want to ideally make sure there is enough coverage on the property to protect the amount that you are owed. It may be wise to make sure the first year of insurance is paid 100% in full prior to closing with your buyers. As mortgagee you may wish to collect a monthly escrow for the next year’s insurance payment if desired. Tip: If selling via a wrapped mortgage or wrapped deed-of-trust (advanced strategy) it may be wise for your new tenant-buyer to obtain a Homeowner’s policy naming the original bank as the first mortgagee and you/your company as second mortgagee.

✔ (Exit strategy) Renting the home to a renter: Two types of insurances may be involved here, 1.) Landlord insurance held by you/your company to protect your mobile home’s structure and liability in case of accidents on your property. 2.) Renter’s insurance for your renters, obtained by your renters. It may be a good idea to make it a requirement for your renters to obtain renter’s insurance before signing agreements, getting keys, and moving into your property. An insurance binder showing a paid-in-full policy should be provided at lease signing. Tip: Renter’s insurance may be another way to prescreen your renters. Additionally, in the event of a major claim your landlord policy will cover the damages. However if the claim is due to the renter’s neglect or fault, the landlord may make a claim on the renter’s policy for the cost of the deductible of the landlord insurance. Tenant already in place: If you’d like your current renter to obtain insurance and you have not required renter’s insurance then you have a few options. 1.) Wait for the lease agreement date to end and insist on renter’s insurance moving forward. In this case a new lease with insurance verbiage will be signed. 2.) Do not wait for the least date to end and send a polite suggestion email/letter listing all the benefits of renter’s insurance and suggest the renters obtain renter’s insurance if financially possible. 3.) Contact your renters and let them know you will reimburse the cost of renter’s insurance from the next rental payment due to you. Suggest an insurance agent you trust. While you are paying for this cost upfront the liability protection may be worth the cost down the road. 4.) Do nothing. Many landlords do nothing and are just fine much of the time. Tip: You or your company should be named as additionally insured if/when insurance is obtained by your renters.

What situations may I not want property insurance as an investor?

In some situations, you may desire to not carry insurance on your properties. Whenever this is decided make certain to have a valid reason and also get the opinion of experts you trust.

✔ (Exit strategy) Selling for cash: When selling for cash to a new buyer, the home insurance is none of your concern moving forward. However if you are planning a quick fast-turn (flip), where you own the home for less than a few days, an investor may choose to not place insurance on this home. This is a calculated risk. Remember not everything goes as planned every time; your buyers may always back out before closing. Tip: If you have the name and contact information of a insurance agent you like and trust, it may be friendly/wise to provide this contact to your buyers moving forward.

✔ (Exit strategy) When owning or renting: When you are thrifty, shortsighted, and/or love taking calculated risks. After writing this previous sentence I take back what I said about being thrifty, losing your home or being sued for an injury may likely be very expensive and/or ruin your entire business.

✔ (Exit strategy) When selling via owner financing: If you are investing more than $9,000 into each of your mobile home properties total, including the purchase cost, repairs, holding costs, closing, marketing and reselling costs, then requiring your payment-buyers to obtain homeowner’s insurance may be the safest way to move forward for everyone. However, in specific situations where you are selling dozens of less-expensive mobile homes you may choose to self-insure your properties. In situations where you are holding many notes you may choose to have your buyers pay you $30-$50 monthly in lieu of obtaining traditional homeowner’s insurance through a traditional insurance company. Tip: In the event of damages or catastrophic loss the home owner/buyers will receive no money. Additionally, you will receive no money as there is no insurance company to pay you. In the event of an injury you are the bank in the situation and not the owner of the property. In the event of total loss it may be wise to move this long-term tenant-buyer into another vacant property you may have and apply some of their past payments to this new property. You will not go after the tenant-buyer for any monies stilled owed on the total loss home. Disclaimer: This strategy is mentioned however not advised for most novice or intermediate real estate investors.

✔ (Exit strategy) When selling via a Lease option program, Rent credit program, or Land contract method: When you like to live with some risk in your life, in addition to putting the buyer’s future home at risk. Without insurance you, your tenant-buyer, and the property/dwelling are unprotected from lawsuits and/or total loss.

What to do next as an investor?

Take a deep breath and know that you are on the right track with real estate investing. Now is your time to do more research. Call around to multiple insurance companies/agent with your home information and goals. There are nationwide companies to choose from as well as specific state-based insurance companies that work solely within your state. Perform an Internet search for “mobile home insurance companies in [my state or city]”. In addition to performing this search also try getting quotes through agents from Allstate, Foremost, State Farm, Liberty Mutual, Farmers, and USAA (for military members).

While calling these companies aim to establish a relationship with an agent that you like that will assist with future mobile home quotes as well. Ask as many questions as possible and obtain quotes based on various coverage amounts, deductibles, exclusions and riders (listed above). Again, aim to work with an agent you like, is knowledgeable, experienced, patient, and you trust.

In conclusion, no one can predict the future. We may only make/do the best decisions at the present time to help grow/protect our future-self, family, and our businesses. The decisions we make now may affect us long into the future. Have fun!

Did we miss anything? Please place any mobile home comments or questions below.

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

.

Related videos:

.

13 Responses

This comes at the perfect time for me. I’ve been searching around trying to piece things together when it comes to mobile homes and if insurance is needed. I get conflicting advice so I’m extremely thankful you laid everything out. Such great information. Thank you for making this. It is easy to understand and you are a good presenter. Now I need to do some thinking on my situation. Thanks again. Sincerely, Jeremiah Wells

Hi Jeremiah,

Thank you so much for reaching out and connecting. I’m very glad to hear that this article and video have been somewhat helpful to thus far. Moving forward if you ever have any mobile home related questions or concerns never hesitate to reach out any time. Happy to help when possible. Keep up the good work. Keep in touch.

Talk soon,

John

Are there insurance companies you recommend for mobile home park liability insurance?

Hi Austin,

Thank you for reaching out and connecting. With regards to liability insurance for mobile home park owners I would definitely encourage you to reach out to Farmers insurance, Nationwide, Philadelphia insurance company, and Hull and Company. There are many other companies as well however definitely start with these and make sure you are dealing with someone that you like, has competitive rates, and ensures everything that you are looking to have insured. Great work owning the communities that you do… Or the communities that you alone in the future. I hope this helps and starts to point you in the right direction. As always, if you ever have any follow-up questions or concerns never hesitate to reach out any time. Keep in touch. All the best.

Talk soon,

John

How much insurance should I carry when selling for payments? Does this get paid by me or the buyer? Thank you for any help.

Hi Jim,

Thank you for reaching out and connecting. The choice to carry insurance is up to you as the note holder as to whether you want the tenant-buyer to obtain insurance on the property or not. You can make this optional or mandatory for your tenant-buyer. The amount of liability you have on the property can vary however the coverage for a complete loss should ideally cover how much the tenant buyer still owes you on the property. If you are truly selling the title and becoming a lien holder then you’ll want the tenant-buyer to obtain a homeowners insurance policy listing you and your company and contact information as the mortgagee. However if you are selling the home with a lease option or some other type of contract where the tenant-buyer will not receive ownership until the end of the agreement, then you will be the one to have a homeowners policy listing you or your company as primary insured. The tenant-buyer will want to get renters insurance to protect the contents of the home. In any of these situations above the cost should be passed on to the tenant-buyer in my opinion. With that said there certainly are number of ways to do this. I hope that this all helps and answers your question. As always, if you ever have any follow-up questions or concerns now or moving forward never hesitate to reach out any time.

Talk soon,

John

This is a fantastic article! Currently I use State Farm in GA for my personal mobile home. I am putting another brand new single wide on my property for a close family member in which she is paying for. She is also using State Farm. Have had a very pleasant experience with them. I am getting a mobile home park under contract today in which I am wholesaling, so if my buyers have any questions about insurance, I can direct them here! Thank you John!

Hi Jennifer,

Thank you for reaching out and connecting. Additionally, thank you for the detailed message. Glad to hear State Farm is working for you in Georgia. Congratulations with regards to getting this park under contract! I have no doubt that this did not come without hard work and effort on your part. Do you wholesale mobile home parks regularly? If so I would be interested in speaking with you in the future. Definitely feel free to reach out to me anytime. You can certainly point your folks here if needed. As always, if you ever have any follow-up questions or concerns now or moving forward never hesitate to reach out any time. All the best. Keep in touch.

Talk soon,

John

Hey John,

New to the manf’d home world, Really appreciate your insight. I’m currently considering a cash purchase of an older unit in Tampa Bay area, which happens to be in a relatively convenient location, in a seemingly well managed park, with the special bonus of a private view / adjacency to a river near Tampa Bay. My thought was to initially to fix it up, live in rent free and ultimately sell in a few years. It appears to need $10K or more in work for numerous reasons, such as some water damage and missing much of its vapor barrier & underside insulation.

Question: Would you consider an older mobile home that is not eligible for structure coverage (can prob only get separate liability / personal injury coverage) a “deal breaker”? As you prob know, Florida has some pretty stringent criteria given the various storm damage risk factors. I have called a bunch of insurance carriers and it seems like anything older than 1991 and/or too close to water/flood zone is completely ineligible!

It seems risky to me, but that might technically rule out rehabbing any older units in FLA?

PS- when I mention rent-free, I mean low rent (lot fee of ~$500/month) in particular compared to my family’s current monthly housing expenses.

PPS – Figured no better way to learn about all this than thru “immersion”. Just don’t want to be completely foolish about it!

Hi Joanna,

Thank you for reaching out and connecting. Please see my thoughts below in bold.

New to the manf’d home world, Really appreciate your insight. I’m currently considering a cash purchase of an older unit in Tampa Bay area, which happens to be in a relatively convenient location, in a seemingly well managed park, with the special bonus of a private view / adjacency to a river near Tampa Bay. My thought was to initially to fix it up, live in rent free and ultimately sell in a few years. It appears to need $10K or more in work for numerous reasons, such as some water damage and missing much of its vapor barrier & underside insulation. Understood. Thank you for the detailed comment as a certainly does help me point you in the right direction. Additionally, thank you for your kind words. I do hope that these articles have been somewhat helpful to thus far. It sounds like this potential mobile home need some repairs however is definitely still very livable at the moment.

Question: Would you consider an older mobile home that is not eligible for structure coverage (can prob only get separate liability / personal injury coverage) a “deal breaker”? Not at all. Homes like this can be very valuable and desirable still. As you prob know, Florida has some pretty stringent criteria given the various storm damage risk factors. Understood. Many parks in FL will not require that you carry insurance on your MH, however it is a great idea to have insurance if possible. I have called a bunch of insurance carriers and it seems like anything older than 1991 and/or too close to water/flood zone is completely ineligible! Try checking with your insurance broker about a Citizens policy, this is the insurance through the state that may be more expensive but may cover the home when others wont. However if you are still unable to get insurance than this is simply a decision you must make to move forward or cancel the deal due to lack of insurance. In my opinion the should not cancel the deal if the rest of the numbers may good sense and you like the home, location, and park.

It seems risky to me, but that might technically rule out rehabbing any older units in FLA? In my opinion this is not a dealbreaker at all. however you should know exactly what you are buying and all the steps to move forward safely. Additionally, it is not uncommon in Florida or other states when it comes to older mobile homes. I hope this helps and starts to point you in the right direction moving forward. If you have any follow-up questions or concerns never hesitate to reach out any time.

Talk soon,

John

Hey John,

Wow- thanks so much for the quick and thorough feedback. Most impressive! I definitely asked about Citizen’s but need to keep pressing. Several agents immediately advised they don’t work with it – even those listed on the Citizen’s website as providers! Their aversion was pretty clear. I fully suspect the process is more trouble (i.e., very little money, lots of headache) than most insurance groups want to take on, which is not hard to imagine with a govt run program.

I only recently discovered your website and treasure chest of mentoring info/videos. Still working thru it all but aim to be in touch before long! Thx for your positivity 🙂