Welcome back,

In this article we are going to be discussing Land Trusts and Personal Property Trusts and how they can affect your mobile home investment business.

Land Trusts and Personal Property Trusts

- Land Trusts hold property with land such as; mobile homes with land, single family homes, townhouses, condos, raw land, etc.

- Personal Property Trusts hold personal property such as; mobile homes on leased land and in park, car, truck, jet ski, coin collection, snow mobile, etc

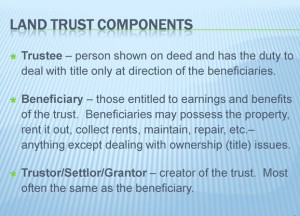

Definitions:

Mobile Home Personal Property Trusts & Land Trusts:

A Trust is a legal arrangement in which the Grantor (the owner selling the property)sells something (land, car, house, mobile home) in to an established Trust for the benefit of one or more beneficiaries.

A “Trust” is a shell entity. Either you may create this document for free or you may pay an attorney to create this document. A trust can help shield your property’s true ownership from the prying eyes of the public, attorneys, almost everyone.

Beneficiary(ies):

Individual(s) or company that receives owner benefits of Trust such as; cash flow, appreciation, tax shelter, income, etc. Each trust spells out the duties of the Beneficiary as the owner. The Beneficiary is typically you or your company when you purchase your investment mobile home. If your state has a Homestead Tax exemption then as Beneficiary this “Homestead Exemption” can be placed on the property if it is the beneficiary’s primary residence. A Trust can have a single beneficiary or multiple beneficiaries who may or may not be treated alike.

Trustee(s) =Owner of Record.

The Trustee must sign as buyer and seller of the property at the time of purchase and sale. Your Trustee has the full rights to sell, rent, lease, fix, insure, and refinance the property within the Trust. Your Trustee should be someone you trust and have 100% confidence in – after all they can legal sell your property as owner of record and walk away with your profits. Your Trust can have a single Trustee or multiple Trustees. Each Trust Agreement agreement spells out the duties, responsibilities, and protection of the Trustee and Beneficiary. A Trustee is often time referred to as a puppet for the Beneficiary. The Trust Agreement also gives the Trustee the obligation to never divulge who the Beneficiary is, unless under subpoena.

The wording in the Trust Agreement is to protect the your Trustee just as much as the Beneficiary. Your Trustee is not liable for anything that happens on the property. In addition the “person” signing as Trustee is not the same person when he or she is not signing as Trustee. Example below:

Bob Davis as Trustee of Personal Property Trust #123 is not the same person as Bob Davis.

Why do you choose to use Land Trusts and Personal Property Trusts?

Trust agreements are super simple to create. They keep your property safe from probate should the owner pass-away without a legal Will. Your Trustee signs on behalf of the Beneficiary, if the Trustee passes away or gets fired then a successor Trustee is already listed on the Trustee agreement and seamlessly takes ownership.

How do I get my properties in to a Trust?

The property is sold in to the already-create Land or Personal Property Trust through a “Warranty Deed to Trustee”.

Once the home is sold into the Trust the Title or Deed may read:

Bob Davis as Trustee of Personal Property Trust #123, or simply, Personal Property Trust #123.

What paperwork is needed to transfer my property into a Land Trust or Personal Property Trust?

To sell your property into a Trust of your choosing you will need:

- A Land Trust agreement or Personal Property Trust agreement you trust.

- A Warranty Deed to Trustee to sell the property to the Trustee and place the home into the Trust.

Conclusion:

In conclusion we have only skimmed the surface of the benefits and uses of Trust. Trusts come into play as a crucial factor when we sell mobile homes inside parks and on private land. Your Trust agreements should always stay safely protected in your private files or home safe. Whether you control one property or 50 it may be prudent to have your name hidden from public record. Protect yourself in advance.

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

Related videos:

29 Responses

Great info John. I love that you already incorporate personal Property trusts into your program. Thank you for putting together a training program that really rocks! Ted J

Great information on trusts. They’ve somewhat eluded me in the past as to how they work exactly and this article helps a great deal. I do wonder though if you could explain a little more in detail exercising the power of attorney to kick out your non-paying T/Bs. Does this involve getting rid of your trustee which then gives you back all power making decisions? Do you need a new trustee then? This tactics seems like such a great safe way to protect yourself and not get eaten up by holding costs through the foreclosure process.

Hi Steve,

Thanks for the kind words. There is much more to be explained and understood about why trusts can be extremely useful for all home owners and investors.

See my answers below to your questions.

Question: I do wonder though if you could explain a little more in detail exercising the power of attorney to kick out your non-paying T/Bs. Does this involve getting rid of your trustee which then gives you back all power making decisions?

Answer: On the contrary the TBs, aka the owners of the property at this point, agree to revert their interest as beneficiaries back to you or your company.

Question: Do you need a new trustee then?

Answer: Trustee always remains the same person until you are paid in full, they quit, pass way, or you fire them.

Question: This tactic seems like such a great safe way to protect yourself and not get eaten up by holding costs through the foreclosure process.

Answer: Land Trusts and Personal Property Trusts are a great way to protect yourself from many things. However I do not see how you would be protected from holding costs during the foreclosure. Your name may not be listed on public record as owner but if the mortgage is in your name your credit will be harmed, and someone still has to pay for the utilities if you want modern comforts?

Talk soon,

John Fedro

John,

How do you do seller financing with personal trust? Is your buyer beneficiary and you are trustee? Is there any way to avoid Dodd Frank and/or SAFE act with personal trust?

PA state allows to sell 4 property without broker license per year. Does it mean you can create many trust and sell 4 mobile homes per yer per each trust?

Thank you,

AB

Hi Andriy,

Glad you got the answer to the last question. To answer the first 2 questions see below.

A personal property trust will not finance a property by itself. The trust paperwork and the financing paperwork are two completely different processes. I have always used trusts to purchase and hold homes. I believe there are many benefits to using them and this, in a nutshell is why I still use them and teach to use them. There is no way to “get around” the Safe act or Dodd frank act if you are doing things that fall within their scope. If you do not fall within their scope of jurisdiction then you do not need to concern yourself.

Eventually the buyer will be the beneficiary and you, your company, or someone you trust will act as the Trustee.

Talk soon,

John Fedro

I found answer to my own question 🙂 on your BP Blog

“Do Personal Property Trusts help hide our identity? or Can I simply buy/sell in my LLC or children’s names?? If it looks like a duck and quacks like a duck, it’s a duck. The methods listed above will give some anonymity to your business but if you were in front of a Judge and found out to not have a license it would be necessary to obtain a license to continue investing legally. If you are the mastermind and receiving the tax benefits you should become licensed once you realize you want to continue making money with mobile homes”

Hi Andriy,

Glad you found the answer. 🙂 Exactly.

Talk soon and happy to help,

John Fedro

Hi John,

I couldn’t find the documents you mentioned in your “Mobile Home Buying Contacts In Parks” video. Specifically the seller questionaire, exterior/bath/kitchen/mechanical checklist, Personal Property Purchase Agreement, personal property trust, Bill of Sale, After agreement for closing, Promisory note (with attached security agreement).

Also, what other document is required in Texas? is it the SOLs?

Thanks so much for all the advice and guidance. Your a huge help for such a small niche community.

-Rich

Hi Rich,

Thanks for commenting and your kind words. You are correct. This video has a lot of useful content so I was wrestling with taking it down due to the fact I do not offer these forms for free any longer. They are a part of the Mobile Home Formula training program we offer along with every other form and script we use on a weekly basis. If you would like to learn more about this program click here. https://mobilehomeinvesting.net/may-i-see-an-example-of-the-mobile-home-deal-maker-formula-training-demo-proof

With that said the SOL and Texas specific how-to can be found at this link. https://mobilehomeinvesting.net/texas-mobile-home-ownership-transfer

Again I apologize about the confusion and would be happy to help you with anything else I can.

Talk soon,

John

Hi John,

On the training program you offer how much is the “Deal Maker Formula training” where you have access to the modules, and 24/7 email support to a coach; however I do not see a cost.

Under the “work with me” tab I see the platinum access program with a price. Is the platinum access a lifetime membership like the other membership?

Thanks,

Rich

Hi John

I was reading the information on personal property trust. My question is where can I find the document?

Hi Jim,

Thanks for asking. A few years ago I provide this info for free. Since then I have gone on to create videos and tutorials with regards to filling all these forms out. They are now a part of the Mobile Home Formula training program. The forms can be confusing and a bit difficult to fill out if you do not know what you are doing. This is a big reason the training is provided. If you would like more info about this please email me personally and we can always talk more. I hope this helps and makes sense.

All the best,

John

Great website, John. I am looking to get into mobile home investing and wonder if you could recommend a Texas attorney that might be able to help me navigate through seller financing options given the SAFE Act and Dodd Frank. I appreciate any info you can provide. Thanks again!

Hi Doug,

Thank you so much for your kind words and commenting. In Texas I highly recommend Dan Castro out of Austin Texas. Here is a link to his website. https://www.teknolaw.com/ I hope he is able to help you as much as he is helped me.

Talk soon,

John

Hello,

Thank you so much for writing these informative blogs! My wife and I in California are very excited to start buying and selling mobile homes. I was redirected here from another blog where you talk about Dodd Frank and seller financing (https://mobilehomeinvesting.net/2014-safe-act-and-dodd-frank-for-mobile-home-investors/). In that blog, you talked about how seller financing with an *unsecured* note means that the seller financing limitations of Dodd Frank don’t apply – but then the seller carries almost 100% of the risk. However, to avoid risk, you mentioned that utilizing a Personal Property Trust could help alleviate risk. Could you elaborate on how a PPT can help sellers like my wife and I avoid this risk?

Thank you!

Andrew

Hi Andrew,

Thanks you much for your kind words and for following along. Please let me first say that using a personal property trust does not do anything to protect you from seller held financing rules and regulations by itself. What the personal property trust does allow, is for the investor and tenant-buyer to both have interest in the property until the investor (seller) is completely paid in full for the purchase price of the home. At this point the investor will then release all equitable interest and ownership in the mobile home. Without going into a great bit of detail in this comment section I hope that this helps answer your question and point you in the right direction. If you have any follow-up questions or concerns never hesitate to reach back out anytime. Keep in touch.

Talk soon,

John

DEAR JOHN,

I HAVE AQUESTION PLEASE. MY DAD BECAME HOMELESS A COUPLE OF YEARS AND SO MY HUSBAND AND I BOUGHT A MOBILE HOME FOR HIM TO LIVE IN AND AS INVESTMENT. WE TOOK OUT THE LOAN (NOT MY DAD) FOR THE HOME IN SENIOR HOME PARK IN CALIFORNIA. BECAUSE MY DAD WOULD BE LIVING IN THE MOBILE HOME THE PARK REQUIRED US TO ADD MY DADS NAME TO THE TITLE AND TO BE BANK LOAN. MY DAD KNOWS THAT WE BOUGHT THIS HOME TO KEEP HIM SAFE AND OFF THE STREETS AND HE DOES NOT WANT ANY INTEREST OR OWNERSHIP OF THE MOBILEHOME AND FRANKLY SINCE MY DAD IS ON A LIMITED INCOME IT SCARES ME THAT HE IS ON THE TITLE. IS THERE A FORM THAT I COULD USE THAT WOULD RELEASE ANY INTREST OR OWNERSHIP THAT MY DAD COULD SIGN? I WOULD JUST LIKE TO MAKE SURE THAT MY DADS BILL COLLECTORS WOULD NOT BE ABLE TO TAKE THE HOME FROM US JUST BECAUSE WE WERE FORCED TO ADD HIM NAME TO THE TITLE SO HE COULD LIVE THERE.

I APPRECIATE ANY HELP YOU MAY BE ABLE TO GIVE ME.

DANI

Hi Dani,

Thank you for reaching out and connecting with regards to your questions. I very much regret to hear about your father’s situation and the hardship this seems to be causing you and your family.

What state is this property located? In almost every state the problem will not be changing the title, it will be the issue of the bank allowing you to change the title. This is because the lender or bank or lien holder is holding an electric or physical copy of the title that is kept out of your reach. Additionally, there is likely a lien holder’s position on this title that would keep you from changing ownership in any way in most situations. With that said, every state is a bit different and if your call up your states titling department, local DMV, or manufactured housing division they will most likely be able to point you in a specific direction based on your situation and the address of your property. If your father passed away then I know this is cause for the title to be changed, however I am not sure if a bank will easily retitle a property without you going through the entire loan origination process in obtaining a new loan all over again. This would be essentially having you and your father sell the home to only you. This may be a problem simply for the fact of having your father sign as seller, not to mention providing the funds to close and pay off the existing loan. If you are able to pay off the existing loan then once you have free title you may change this with only the signature of your father and yourself, and paying a small fee. Again, my advice to you is to call the state and asked them specifically about your specific situation.

With all that said, the little experience I have with debt collectors and helping folks that are working with debt collectors is that a mobile homes title is typically never in jeopardy unless going through a bankruptcy of some kind. While sure this does not alleviate too much of your concern I do hope it helps and points you in the right direction. As always, if you ever have any follow-up questions or concerns please never hesitate to reach out any time. Keep in touch.

Talk soon,

John

Thank you John Fedro for article “Mobile Home Personal Property Trusts & Land Trusts” I have to given try. Mobile home investment is a new idea to many citizen. As like me, many will confused with title whether it is technology supported or paper works. Thanks for sharing.

Hi Changrabengra,

Thank you so much for commenting and reaching out. I am so glad to hear that this article has been helpful to you thus far. Moving forward if you have any follow-up questions or concerns never hesitate to reach out any time. Always here to help.

Talk soon,

John

Hi

First we live in California. My sister in law can not own property or it may mess up her benefits.She is disabled ans a trust is best way to go anyway. We found a mobil home in a park that we can get for her. Where is the forms for a family trust to protect the property?

Thank you

Donna

Hi Donna,

Thank you for reaching out and connecting. A trust may be the exact thing to keep your name hidden from public record. While I do work with active mobile home investors and real estate investors with regards to placing their properties inside land trusts and personal property trust, I do not work with non-investors looking to place their own properties into trust. The reason for this is because these forms have specific instructions with regards to how to fill them out and where to file them when needed. For this reason I very much encourage you to contact a local real estate attorney in your area. They will absolutely be able to give you the best legal information for your situation. I hope this helps and make sense. Moving forward if you ever have any follow-up questions or concerns please never hesitate to reach out any time.

Talk soon,

John

Hi John, Thank you for having this helpful site! I have a question for you. My mother has a regular non mobile house in Massachusetts which I as her son, am listed as the Trustee for. She wants to sell this house and then purchase in cash a mobile home also in the same state and county. Since this mobile home is on leased land therefore, it is considered a personal property. What happens to the current trust on the existing house? Does it automatically transfer to the mobile home even though it is considered a personal property or what needs to be done if not to protect it so if something happens to her it does not go to probate court?

Hi DC Underhill,

Thank you for reaching out and connecting. Additionally, thank you for the detailed comment as the certainly does help me understand your situation a bit more. If I am understanding things correctly, then when your mother (who I’m assuming is the beneficiary) instructs you to sell the home and land than the ownership will come out of the trust and into the new buyers name. That means there will be an empty land trust, or at least until you rip up the paperwork. The new mobile home is personal property as you mentioned, so this will require a personal property trust. This does much of the same things as a land trust however of course is for personal property such as mobile homes in parks, cars, etc. I hope that this helps and answers your question. If you have any other follow-up questions about this or anything else never hesitate to reach out anytime. All the best. Keep in touch.

Talk soon,

John

A notice of assignment of trustee was signed between the seller and the investor in March. Verbal agreement stating mobile home would be repaired and sold in 45 days and $35000 going to the seller once the property is sold. Mobile home has not been touched but investor is paying land rent seller has moved into new home and mobile home has been empty since March. No money has been given to seller

Thanks for commenting and reaching out. This deal certainly seems interesting and I love that there is so much going on. The verbal agreement with the home being repaired and sold in 45 days with $35,000 going to the seller is definitely not ideal to have this only as a verbal agreement and not written down. It sounds like investor might have said what they needed to say in order to move into the new mobile home and simply live there. I of course do not know what is in the investors head or what is truly going on with the deal, however if the investor is paying for the land then they do not sound like they are in default with this part of the deal. It sounds like this investor may not be interested in the mobile home that needs the repairs. Perhaps you can resell this to another investor that wants to buy it and move it off of the land if possible. However if you are trying to keep it there then that certainly makes things a little bit more complicated. Feel free to write back or email me directly at John@mobilehomeinvesting.net for further help. Happy to help if possible moving forward.