Welcome back,.

In this article we are going to discuss the question “Is purchasing a new mobile home a good investment?” Let us talk about the growing demand of semi new mobile homes in parks that are grossly over financed with bank liens and mortgages. Many of these homes are almost impossible to resell due the current market conditions and bank lending restrictions.

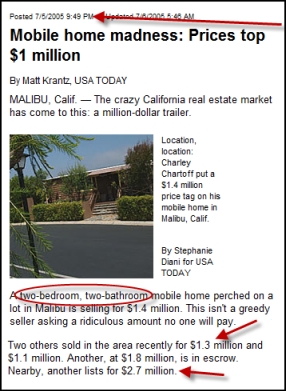

Let us imagine you are a hard working American that desperately wants to own a home of your own. The year is 2000-2007 and there is a real estate buying frenzy. You do not have the best credit but that is alright as banks are lending to anyone these days. You discover that traditional real estate in your town is going for $170.00 or more per square foot. However a brand new mobile home is selling for only $62.50 per square foot. Good investment idea right? It depends.

Here is what you know:

- You desperately want to own a new home to call your own.

- You can purchase a brand new 1,600 square foot mobile home with bank financing for a quarter of the price as a new traditionally built house.

- You do not want to purchase land because that will only increase the price you must repay. You decide to place your new mobile home inside a preexisting mobile home park in your local area.

- The mobile home dealer has impressed upon you that home ownership is the American dream and the way the market is going you can’t lose. I have actually heard this from more than one mobile home seller I have spoken with..

Knowing all this would you finance the $50,000, $90,000, $120,000 for a new mobile home to be placed inside a mobile home park? As an investor you would likely not..

This is the exact situation many mobile home owners who bought a NEW mobile homes between 2000-2010 are in right now. Many of these buyers did not fully understand the repercussions of the loans and mortgages they were agreeing to. Many of these buyers were not ready to be home owners...

Unemployment numbers:

CNN online reports 7.9 million jobs have been lost since this economic down-turn began. Many of the blue and white collar jobs that hard working mobile home owners were relying on to pay their bank loans and other bills have evaporated. Many hard-working mobile home owners are now left with little choice but to downgrade to apartment living and must try to sell their used mobile homes with expensive loans. This situation mimics the housing market in many areas however without land that the home owner owns a mobile home park may evict this mobile home and mobile home owner within weeks of nonpayment of park rent...

Downgrade to Apartments:

In my local area a 3 bedroom and 2 bathroom apartment will rent for $950-1,050 per month. A 3/2 mobile home bought for $80,000 and financed for 15 years through a bank at 10% annual interest will be roughly $860 per month. Do not forget to add on taxes, hazard insurance, and your park lot fees and your monthly payment can skyrocket to over $1,200 per month easy. .

Options for home owners that must sell:

If an mobile home owner cannot pay their monthly mortgage payment it is likely to assume that they cannot pay for the monthly lot rent payment for the park. After 30 days of non-payment to the mobile home park many communities will begin the eviction process to remove the home and owners from the premises.

- Banks have critically stopped lending on used mobile homes inside parks. This will make many buyers and mobile homes unapprove-able for new purchase mobile home loans.

- Used mobile home buyers do not have the $30,000+ to pay cash for these over priced homes.

- Banks will typically only do short sales if payments have been in default for over 90 days. By this time most owners have been removed from park for non-payment of park rent.

- Mobile homes are costly to move. If a mobile home seller does not have the $1,200 plus or minus to pay their monthly payment to the bank and park then he or she will likely not have the $5,000+ to move the mobile home to another park or piece of land.

- Sellers with high manufactured home loans have little choice other than to list with a Realtor and hope for a fast sale or try to work with their bank on a successful forbearance or loan modification..

Benefits to cash buyers and mobile home investors:

Once the mobile homes have gone through the foreclosure process they will be “for sale” by the bank at a steeply discounted price. The mobile homes often remain in the same parks that they were originally moved into.

- Purchasing a 3 or 4 bedroom mobile home built in 2000-2010 for under $8,000 can be a regular occurrence. Depending on the bank some degree of conventional financing may even be an option if you choose to purchase more than one mobile home. .

Conclusion:

At least every other week I will speak to a seller that purchased a new manufactured home for way too much money if they planed to resell anytime soon. Sellers can obtain financing from the park or possibly local banks for 15+ years. Many mobile home owners may stay only 3-6 years before an emergency forces them to move. Without anyone to purchase this mobile home the seller is in a very tough spot. This is not the dealers direct fault, nor is this the mobile home sellers direct fault – this is a product of over leveraging and not understand the resale value of mobile homes.

Be kind to every seller you speak with and always aim to help every seller and educate every seller before thinking about yourself and how you may profit. From this point of helping and clarity you may be able to create value in the seller’s life and construct a win-win deal. .

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

Related videos:

11 Comments

Jason Nassau

October 27, 2011Hi John, I agree with that you have to say about newer mobile homes that are very over leveraged. Do you feel this is the fault of the dealers and them trying to sell homes to unqualified buyers? I love what you have to say and appreciate your expert advice. – JAson Nassau

John Fedro

November 3, 2011Hi Jason, As far as who is to blame, I am not going to point the finger at anyone. Ultimately if the owner can’t make his monthly debt payments because he or she lost their job it is on the owner’s responsibility. However, I do believe that most mh owners who bought these over-priced (easy-financed) mobile homes would not have bought, and only did so to “keep up with the Jones-es”. – John

Rachael D

November 1, 2011John, Excellent video. Can you elaborate on how I can make a profit from a mobile home in a park with a mortgage on it? Thank you, Rach

John Fedro

November 3, 2011If there is a mortgage on a mobile home inside a park of below $19,999 there is a successful method to make profit on these homes by selling them to buyers that don’t qualify for bank approved financing. I will have more information on this new way of making mobile home paydays soon. I will announce it in an article. Stay tuned :). Thanks for reading.

John

December 30, 2011John,

I just ran across your videos and this is something I have been considering doing for about a year. The problem is I am in the military and already own two homes that I rent. But I do not own any single wide mobile homes. I have ran across a few deals for less than 8000 but they are a bit older than 2000. Are these still good investments. They are in parks and I have not contacted anyone about them yet I figured I would start small and build up. buy one wait a few months buy another. I would like your input let me know what you think.

John Wilson

SSG, U.S Army

John Fedro

January 1, 2012Hi John,

Thank you for reading my blog. I hope it has helped you in motivation and applicable information to get started now. Based on age alone the homes sound promising. You will have no problem reselling homes built as far back as early 80s. Make sure to consider the parks regulations, financing terms if not paying all cash, who and where your buyers are, how much you can resell the home for monthly, repairs, and all homes in parks must be free and clear.

With only a few hours a week there is no reason you can not pick up 1 property every few months. My investors I help average 1 deal every 30-40 days so I believe your goal is very conservative.

To start know for a fact what buyers will pay for a 2/2 and 3/2 mobile home in a park in your area. Advertise in 3 sources (1 online, 2 offline) and determine what these homes will sell for monthly and as a move-in fee. This will help you know what to offer and which homes will cash-flow $300+/monthly to move on.

Sincerely,

John

P.s. Thank you for serving and protecting us all here at home.

Regis Beaken Sr.

May 27, 2013One of the worst part of owning a mobile home that you bought new is that most all banks will not lend money to borrowers of used mobile homes. This is making it almost impossible to sale. If I had $30000 plus dollars I would buy something with land. In our area Pa. Md. I can have a 3 bedroom home built on a .3 acrea lot for as low as $140,000.

John Fedro

May 27, 2013Hi Regis,

I am sorry to hear about your situation. Almost all buyers of brand new mobile homes (or even used mobile homes over $35,000) will be in for a unhappy awakening when they decide to resell in the next 1-10 years. I see it all too often that we as investors are the bearers of “realistic news” and a realistic purchase price, that is usually well below what a seller thought their home was worth.

There are some lenders such as 21stmortgage that will finance a mobile home in a park as far back as 1978. Call my contact there at 800-955-0021 ext. 1251. His name is Steven McMahan and you can ask him more questions.

Best,

John

Regis Beaken Sr.

May 27, 2013I am on Social security and lack the cash needed to invest. I am going to college to be an accountant and intend to eventually flip homes of all kinds. Anyone interested in helping me get started and make a quick 10% profit in say 6 months let me know. I just got my granddaughter a mobile home for $15000 valued at $50,000. In an area that homes are selling for $65,000 and up. I have my I on 3 others that are newer and I’m trying to get money where I can buy these homes at .40 on a dollar. Quick sale .60 on a dollar, making the sale at $39,000 these places would be sold by fall. I need the initial help, but I would enter an agreement with lender and they can hold deed in my name to hold for 1 year at a payoff of $31,000. If you know a bank that gives that type of return please write me.

Jennifer B

January 31, 2017Super helpful John. Thank you for putting this together. I feel like I just dodged a huge bullet by not purchasing a brand-new manufactured home here. Thank you and God bless. Love, Jennifer B

John Fedro

February 4, 2017Hi Jennifer,

Thank you for reaching out and connecting. Very glad to hear that this article has been somewhat helpful to you thus far. Moving forward if you ever have any follow-up questions or concerns please never hesitate to reach out any time. Always here and happy to help if I can. All the best.

Talk soon,

John

Leave A Response