Welcome back,

In today’s video we are lucky enough to spend time with active mobile home investor, Jack. I use the word, “lucky” in the previous sentence because Jack is usually busy working with local mobile home parks, handymen, sellers, and buyers daily. In roughly 2 years Jack has made a local name for himself, formed relationships with nearly a dozen mobile home communities, and built his small mobile home empire into a fulltime cash-flowing business. In the video below we’ll…

[bullet_block large_icon=”13.png” width=”” alignment=”center”]

- Tour some of Jack’s vacant homes (in parks and on land).

- Talk cash-flow, down payments, and selling.

- Drive by and discuss some of Jack’s mobiles.

[/bullet_block]

A special thank you to Jack for opening up his business and providing way more content and value than was asked of him. Thank you!

Changing Lives with Mobile Homes:

After watching the video below it is no surprise that Jack truly cares about his clients and customers. Jack has been a motivated seller in the past and understands the value of establishing win-win purchase and selling arrangements with your buyers and sellers. With nearly 2 dozen properties in his portfolio, Jack has helped positively influence and shape the lives of over 40 families, including both buyers and sellers.

Pro Tip: Stay focused on helping others, not solely on your personal profit. When you help enough people, you will naturaly create profit for your company. There are likely few other mobile home investors locally to help most sellers. Many sellers need a voice of authority to help them understand the local market and what is fair. Look to help and educate sellers first.

Related article: Who’s The Boss? Pros & Cons – Podcast Guest Damarice

Understanding Down Payments:

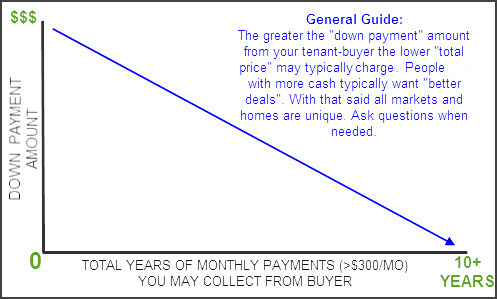

If you plan on reselling mobile homes via monthly payments then you will most likely be requiring a down payment from your prospective tenant-buyers.

Remember 1.) The down payment of your mobile home will very depending on the condition of the home at the time of resale. This means a “handyman special” type of mobile home may only attract $2000 or less for a down payment. However a home that is “move-in ready” will attract a much more substantial down payment depending on your local market. Always know your exit strategy before purchasing any and every property you own.

Remember 2.)

[bullet_block large_icon=”30.png” width=”” alignment=”center”]

- The GREATER the down payment the LOWER the total purchase price you may charge over time.

- Conversely, the LOWER the down payment you accept from a low-risk tenant-buyer, the GREATER total price you may charge over time for the property.

[/bullet_block]

Pro Tip: A down payment greater than 20% the sales price will significantly reduce a tenant-buyers default rate.

Related videos: Determining the Value of Your Manufactured Home When Selling For Payments

Taking back mobile homes (as discussed in video)

While we investors aim to reduce the risk of default as much as possible, taking back mobile homes is simply a part of this business. If you are one many investors who experience an anxiety-attack at the mere thought of a defaulted tenant-buyer, then I urge you to take a few deep breaths.

- If you find yourself with a defaulted tenant-buyer, follow the steps below.

- Make contact to verify status of payment and tenant-buyer’s attitude toward staying in the home.

- Gain clarity on tenant-buyer’s financial situation.

- Establish a firm date for the tenant-buyer to pay the defaulted about plus late fees, or establish a firm date as to when the seller will leave.

- Tape on frontdoor or mail “Notice to Pay or Vacate” notice (times vary by state) while at the subject property. (See related video link below for recorded example.)

Almost all low-risk tenant-buyers you sell to will be credit conscious and mostly very ethical individuals – just like you. If a tenant-buyer cannot pay they know that they cannot stay. With a little bit of time, some kind words, and a little bit of money, almost every tenant-buyer will leave the home clean and on-time. The exception is when a tenant-buyer is angry, irrational, and vindictive towards you for harming or taking advantage of them in some way.

Pro Tip: Act ethically whenever possible.

Related video: My mobile home tenant stop paying me… Now what?

Manufactured homes on land (as shown in video)

Manufactured homes on land represent a huge opportunity for active mobile home investors. Many of the same challenges faced by mobile home sellers in pre-existing parks, are shared by sellers of mobile home with private land. These challenges include…

[bullet_block large_icon=”36.png” width=”” alignment=”center”]

- Financing is difficult.

- Buyers with cash are few and far between (depending on your local market).

- There are few investors (compared to the SFR sector) looking to buy used mobile homes with private land.

[/bullet_block]

While mobile homes attached to land are typically more expensive, due to the value of the land, there are absolutely techniques to purchase these homes and land with very little money out of pocket. Some of these techniques include seller financing, banks, options, private money, and purchasing the home subject to the underlying mortgage, etc. Once the home is in your control you may choose to:

[bullet_block large_icon=”56.png” width=”” alignment=”center”]

- Rent the mobile home and the land together.

- Sell the mobile home, and rent the land forever.

- Sell the mobile home and land together.

[/bullet_block]

Related article: Manufactured Home Investing Walk Through, Purchase, and Acquisition Strategy

Update: At the time of publishing this article Jack has sold 3 homes (via structured payments), and purchase 3 more mobile homes for cash flow.

Bonus: Jack’s advice for new mobile home investors

[img_text_aside style=”2″ image=”https://mobilehomeinvesting.net/wp-content/uploads/2017/01/jack-says-150×150.jpg” image_alignment=”left” headline=”Jack%20says…” alignment=”left”]”I still have much to figure out, and have had plenty of failures along the way, but these would be my top 9 pieces of advice to a new mobile home investor.”

[/img_text_aside]

- There is nothing more important than your integrity and the safety and well-being of your tenant buyers.

- Make sure you understand the worst case scenarios before you start out, so you can avoid them.

- Make sure you understand the legalities in your state as regards selling homes without a license, doing work on them without a contractor’s license, etc. I chose to do everything by the book, but at least educate yourself first so you can have clarity when deciding how to proceed.

- Understand your personal finances and what your goals are with mobile home investing (extra income, leaving the rat race, just having fun and getting experience, etc).

- This is a down and dirty, intense, ‘real life’ business. Many beginning investors dream of using an army of Virtual Assistants to do all the work for them, but this is the wrong approach unfortunately. You need to have an attitude that you are going to jump in with both feet, get dirty, scare yourself, and engage in massive daily action and ‘hustle’.

- Be honest with parks about your intentions. Park managers and owners can be your best friend or worst enemy, so it is important they accurately understand your goals and intentions. This will save you stress later.

- Make lots of offers. This will get you the best deals and allow you to negotiate from a position of power. If you find yourself stretching to make a deal work, it’s because you don’t have enough other homes to make offers on. If your area is too rural to allow for lots of regular offers, branch out into other forms of real estate or other areas so you don’t end up doing bad deals just for the sake of doing a deal.

- Mobile Home Investing is a business, just as serious and potentially lucrative as any other business (or more so). You owe it to yourself, your loved ones, and your customers to treat it as such. Engage in professional accounting, understand the laws, and treat your buyers and sellers the way you would want a business to treat you- with the utmost professionalism.

- Track your progress- the number of calls you make, offers you make, homes you buy, etc. This intentionality will lead to success, compared with just doing it willy-nilly randomly or reactively.

In conclusion you will never learn everything you need to know about real estate investing from reading books or watching videos. While there are many ways to make money in real estate, there are countless ways to lose profits as well. Have fun and take daily action to reach your financial goals. If you have questions, asked them. There are plenty of active investors around to give you help and guidance if you simply ask for it.

Have mobile home comments or questions? We’d love to hear them below?

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

10 Responses

Great advice for newer and more experienced investors. Congratulations Jack. I admire what you have done. Thanks guys.

Hi Joshua,

Thank you for reaching out and connecting. I’m very proud of everything Jack has accomplished in his short time investing as well. Moving forward if you ever have any mobile home specific questions or concerns never hesitate to reach out any time. All the best.

Talk soon,

John

What state is he doing this many Deals in? I ask cause there’s a limit that u can sell without having to have a dealers license

Hi Stephen,

Great to hear from you. Thank you for reaching out and connecting. You’re going to laugh because you talk with Jack almost every week. I’ll go ahead and email you Jack’s location. For other people reading this comment, We have kept Jack’s location and some deal information about a few of his homes in this video a secret as he is actively still investing and has tenant buyers inside of these homes paying monthly. Moving forward if you ever have any additional follow-up questions or concerns about anything never hesitate to reach out any time. Always here for you. Keep in touch.

Talk soon,

John

Hi Stephen-

This is Jack.

Just to clarify re your comment for anyone else viewing the thread, I do in fact have my mobile home dealer’s license 🙂

-Jack

Hey,

I have another email on file that we have talked before. I bought 2 mobile homes the last 2 yrs. Just got my RE license but after a year passing by, I realized I love being involved in MH and the value of income coming in every month. My question is, if you don’t have the capital to buy but you do have enough drive and ambition to negotiate and own MH. Where do you find the old private lenders/ silent partners. If I just mirror images my 2 properties, I could bring 500 positive a month. How do you find a lender to purchase or private fund?

Hi Justin,

Thank you for reaching out and connecting. Very glad to hear about your excitement and ambition with regards to this niche. Congratulations again on your first two mobile home properties! These are the first two of many! Your questions have a few different answers. Let us first assume that you have 100% clarity in your market and know exactly who is selling their mobile home, what they are selling, and why they are selling and when they need to leave. Once you understand this you may make multiple purchase offers to almost every single seller you visit and talk with. It is important to realize that you will be making zero dollar offers as well as owner financing offers as well as some all-cash offers. I mention this because it is important you move forward with the path of least resistance, at least that is my opinion. Now to Really answer your question about how to keep investing on a limited budget… In short you will be using a combination of methods including continuing to save, reinvesting all your profits back into your business, structuring owner financing with sellers, selling homes for cash instead of cash flow, selling notes you have created to raise cash, raising private money, and even taking on capital partners. I encourage you to stay away from credit cards if at all possible. I hope this helps and make sense. Because you are on a limited budget you will be taking a mass approach to talk to almost everyone and you will be doing a balancing act between raising capital, selling homes for cash, and keeping what homes are possible to add to your portfolio of properties. The main goal is to stay busy and continue investing and helping local buyers and sellers regularly. I hope this helps and make sense. With regards to finding private money and partners, I would encourage you to reach out to your local real estate investors Association. Start networking with other active investors in the area. These can definitely be good people to know moving forward. I hope this all helps and make sense. As always, if you ever have any follow-up questions or concerns please never hesitate to reach out any time.

With all that said, I’m very happy to say that I will be coming out with a new article and video shortly on this exact topic. In fact, I received your previous email and have already replied to that one. In that email you mentioned a specific phrase that I believe will be the title of this next video. Thank you for the help in naming the coming next video. 🙂

Talk soon,

John

Congratulations guys! I just learned about this type of investing from a different podcast. I’m super excited about what I’ve been learning so far. I know I have more questions for you soon but just wanted to reach out and say kudos for everything you’ve put together. Cheers! DP

Hi Daniel,

Thank you so much for reaching out and connecting. Additionally, thank you so much for your kind words and positive feedback. Please never hesitate to reach out questions or concerns moving forward. You should definitely have them if you are taking action to help local buyers and sellers locally. All the best. Keep in touch.

Talk soon,

John