Welcome back,

Thanks for visiting. In this discussion we are going to briefly outline the Safe Act and Dodd Frank Act, and discuss how you may choose to safely move forward with your mobile home investing business in easy to understand language. Please read this post in full and all subsequent disclaimers.

In short: The sky is not falling, but you do need to protect yourself.

The reasons for this article are to inform, pose questions, and bring clarity to your mobile home investing business with regards to the new and pre-existing rules concerning reselling mobile homes to end-user buyers with seller held financing.

Seller Held Financing:

A real estate agreement where financing provided by the seller is included in the purchase price. It is also known as a purchase-money mortgage. Seller financing is a mortgage given to the seller as part of the buyer’s consideration for the purchase of the property and is delivered at the same time that the property is transferred as a simultaneous part of the transaction.

The advice given below is not to be considered legal advice. This article has been compiled from discussions with multiple State’s Banking Relating Organizations, Manufactured Home Departments nationwide, conducting simple online searches, discussions with real estate attorneys and others that know much more than I do about these new laws. Please preform your own diligence before proceeding forward.

Let us first have a basic understanding of these new Acts as they apply to your mobile home investing business. I say “as they apply to your mobile home investing business” because these Acts encompass many changes including; seller financing, conventional financing, lending, banking regulations, reporting, home ownership, screening buyers, derivatives, commodities, automobile financing, and much more.

- Seller financing restrictions do not apply to commercial real estate sales.

- Seller financing restrictions do not apply to investment property that is sold to another investor not living in the home.

- Seller financing restrictions do not apply to properties with more than 4 units, such as multifamily properties.

- Concerning the Safe Act: Most states have set a diminimus provision that will allow for up to 3 owner financed sales per 12 month period that may be preformed by you without a loan originator. There is strict criteria that the home and buyer must meet for the financing to be legal. If you are not an investor and selling your own mobile home proceed as instructed here.

- Concerning the Dodd Frank Act: Most states have set a diminimus provision that will allow for up to 5 self-underwritten owner financed sales per 12 month period. These loans must follow the 8 criteria found here (see pages 14-15).

- Using an approved loan originator is a strategy that is legal to negotiate, underwrite, and create your notes and secured mortgages. This may cost between $99-$2,000 or more per sale.

- Fines if caught selling homes illegally with secured Notes and Mortgages/Deeds of Trust will be a full refund of the past 3 years of payments received from this tenant-buyer.

- These new laws took affect January 10th, 2014. Notes created prior to this date do not apply.

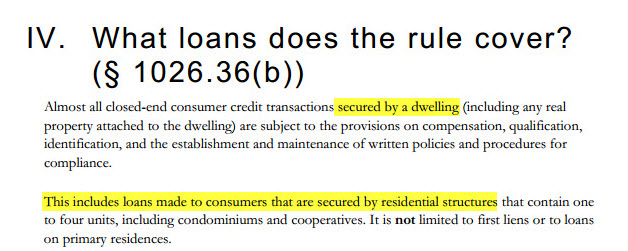

- All Notes and Mortgages/Deeds of Trusts that hold the subject property as the collateral of the debt fall under the scope of the Safe Act and Dodd Frank.

- Personal remark: Attorneys will be looking to work with and help all unhappy owner-financed owners. Please protect yourself and only sell homes through legal methods.

Please realize that these Acts are written on thousands of sheets of paper.The below words only skim the very surface of these rulings. For a complete understanding I encourage you to read the Acts yourself.

The Safe Act:

An Act intended to provide uniform licensing standards nationwide, as these licensing standards had been non-uniform from state to state for the past 20+ years. It was also designed to create a comprehensive licensing database so that all relevant information on Mortgage Loan Originators (MLO) will be centralized and publicly available.

The Dodd Frank Act:

An Act to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end “too big to fail”, to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes.

Now that we have an extremely brief understanding of the general reasoning for the Acts and what purposes they were created we can begin to discuss what these acts mean for us as successful mobile home investors, what these laws prohibit, and how to proceed.

Let us first discuss you buying an investment mobile home with monthly payments from your seller:

This is perfectly legal and is not affected by the acts as you will not be living in the investment home yourself. Proceed as usual.

Let us next discuss you selling your investment mobile home to an end-user via monthly payments inside of a mobile home park:

Selling a mobile home inside a park through monthly payments to an end-user that will be living in the mobile home is acceptable with very-very specific conditions, these conditions require you do not fall within the scope of the Acts. When it comes to selling a mobile home inside a park with payments it is going to be vitally important to not have the subject mobile home as collateral for the loan. The Acts pertain to secured notes only, for now. Not creating a mortgage or deed of trust to secure the home with the financing will leave you with an Unsecured Note. By not having collateral and therefore no recourse to foreclose it may seem as the investor is taking near 100% of the risk. For this reason it is very important we use Personal Property Trusts, Land Trusts, and specific additional supporting agreements.

Is it possible to use a Mortgage Loan Originator when reselling your mobile homes in a community? A licensed and Safe Act approved Residential Mortgage Loan Originator (RMLO) can negotiate, approve, underwrite, and help create your secured Notes, Mortgages, and/or Deeds of Trusts to secured your interest. The cost associated with this depends on your area and each specific RMLO. Costs I have seen range from $99 to $2,000+ depending on the services offered. After the 3 owner financed sales per 12 months sold to end-users with secured notes you should only proceed if you are licensed. If you are unlicensed and proceed with more the 3 transactions this may result in fines if caught, this is relatively new and untested.

Is it possible to have your seller create a note/mortgage to your buyer and then you purchase the note/mortgage for the sales price of the home? Does this make sense? If not see the example below. This technique is not advised by me or this website. While this would seemingly not violate the Acts as the homeowner is the one originating the note/mortgage this method is impracticable in real life. If this was the case the seller would often undercut you and sell directly to the tenant-buyer, also the tenant-buyer would now know your purchase price. In addition we often times find our buyers days or weeks after the original sale of the home. This impracticable method would restrict us from purchasing the home with seller held financing. Additionally the end-user buyer will need to meet strict criteria to ensure they have been verified that they can pay back the entire note. If the tenant-buyer can not pay back the loan you may be held liable for holding a risky loan and subject to fines.

Example: The seller and you agree to a purchase price of $5,000 cash for the seller’s mobile home in a park. You find a tenant-buyer that is willing to pay $15,000 with $2,000 today and monthly payments of $300.00. The seller then creates a Note and Mortgage for the tenant-buyer and all parties agree. Once the paperwork is signed you purchase the $15,00o Note from the buyer for the agreed upon $3,000.00 cash. In short this method is very impracticable.

Can I just simply Rent or resell my used investment mobile home for all cash or bank financing?

Good thinking. However it depends. Many mobile home parks will not allow subleasing or renting within their walls. In addition many buyers will not have $10,000-$40,000 to purchase your used mobile home all-cash. Many banks have strict requirements for lending on mobile homes inside parks and attached to private land.

Let us next discuss you selling your investment mobile home to an end-user via monthly payments while the mobile home is attached to land you also own (AKA not in a mobile home park):

In this situation an approved residential loan originator should always be used to negotiate, underwrite, and help create these loans and secured mortgages/deeds of trust. It is crucial to have a secured loan because you will always wish to have the conventional ability to foreclose on the tenant-buyer should they not pay your Note. It is my suggestion that you almost always use a Lease Option before you sell your mobile home on land with owner financing to ensure your buyer is a low-risk buyer that pays on-time. After a predetermined time you may now utilize the help of your Residential Loan Originator to negotiate, underwrite, and help create the loan and secured mortgage/deed of trust.

Audio below: May not be available on tablets, listen on your PC.

John Fedro and Bill Walston discussing the Dodd Frank and Safe Acts. Click here if you have trouble listening/viewing the audio below.

Conclusion:

Know the laws of your state. Do your own research and do not fall within the scope of these Act’s jurisdiction. In addition make sure you understand how to properly screen your tenant-buyers to verify that they do have the ability to pay your desired home payments.

Know the laws of your state. Do your own research and do not fall within the scope of these Act’s jurisdiction. In addition make sure you understand how to properly screen your tenant-buyers to verify that they do have the ability to pay your desired home payments.

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net

Updated Disclaimer: I have received a few emails asking for free forms associated with selling your mobile home safely from a personal property trust like I mention above. In the article above we mainly discuss reselling your investment mobile home as an unlicensed RMLO investor to an end-user buyer who plans on living in your mobile home. While I covered a number of thoughts for selling and buying mobile homes safely with payments I did not discuss all the paperwork I use on a weekly basis to convey ownership and protect my investment homes. These undisclosed forms are legally very important to the transactions. These forms are located in the Mobile Home Formula online training program. Today’s article is not a sales pitch for this product. Because members have invested for these documents I will not be making these forms and agreements available for free. I hope this make sense and is fair too all.

Updated Disclaimer: This website and the Mobile Home Formula training website strives to bring you the most relevant and up-to-date information concerning your mobile home investing business. The statement that only Notes with secured debts apply to these rules may not always be true. In reality overtime the Consumer Financial Protection Bureau that is in charge of these acts may change or update these laws to reflect unsecured notes. We here will keep you posted if this happens and suggest alternative legal avenues to sell your investment mobile homes with monthly payments.

This site is dedicated to providing the most up to date information. If you have additional information about these acts or see changes that you feel are inaccurate please comment below. We are all here to learn and grow together.

Online Sources:

- http://www.consumerfinance.gov/regulations/ability-to-repay-and-qualified-mortgage-standards-under-the-truth-in-lending-act-regulation-z/

- http://files.consumerfinance.gov/f/201307_cfpb_mortgage-implementation-readiness-guide.pdf

- http://www.stlouisfed.org/regreformrules/final.aspx

- http://en.wikipedia.org/wiki/Secure_and_Fair_Enforcement_for_Mortgage_Licensing_Act_of_2008

- http://en.wikipedia.org/wiki/Truth_in_Lending_Act

- http://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consumer_Protection_Act

- http://noteinvestor.com/buy-notes/dodd-frank-mortgage-laws-seller-financing/

- http://www.investopedia.com/terms/s/seller-financing.asp

- http://www.thebankadvisors.com/assets/2013.DFA_Mortgage_Workshops/Saltmarsh%20DFA%20

- http://files.consumerfinance.gov/f/201411_cfpb_atr-qm_small-entity-compliance-guide.pdf

Related Video:

.

22 Comments

Ralph Bailey

December 29, 2013Holy cow this is superb! I have only been seeing negative comments talked about this topic. No one besides you has said anything positive or attempted to give out practical advice. I thought selling mobile homes through payments was dead. What is your advice structuring lonnie deals?

Thank you so much for this John and support team.

Sincerely,

Ralph Bailey

John Fedro

December 29, 2013Hi Ralph,

Thank you for the kind words. Happy to help provide you with some clarity and keep you moving forward in this business. Personally I can’t stand when folks offer only negative criticisms without giving helpful advice to follow. Thanks for reading and commenting.

Lonnie deals need to be modified to sell the mobile homes without any collateral, interest, junk fees, or pre-payment penalties etc. I hope this make sense? Let me know if you have any follow up questions or thoughts.

Talk soon,

John Fedro

David

January 9, 2014By making this statement, “Not creating a mortgage or deed of trust to secure the home with the financing will leave you with an Unsecured Note. By not having collateral and therefore no recourse to foreclose it may seem as the investor is taking near 100% of the risk. For this reason it is very important we use Personal Property Trusts, Land Trusts, and specific additional supporting agreements,” are you saying buying the property inside of a trust could protect us from the acts and also help us fall outside the scope of the Acts?

John Fedro

January 9, 2014Hi David,

Thanks for commenting and very good and important clarification question. NO, we am not saying that using a Trust of any kind will make you instantly compliant or keep you safe in anyway simply by using a trust. A trust is not a tool to skirt ANY type of laws anytime. What we are saying is based on how we have read the Acts that using unsecured notes when selling mobile homes inside parks and seemingly taking the risk on yourself by having no mortgage or deed of trust or collateral of any kind does fall outside the scope of the Dodd Frank act as currently written.

Does this make sense? Any follow up questions?

Talk soon,

John

Nick De

January 13, 2014Thank you John and Bill I really needed to hear this. It sounds like you both have done a lot of planning and have experience in this field. You seem to know more than most others I have heard from. How do you work around the 5 deals on land with mobiles?

Nice De

John Fedro

January 13, 2014Hi Nick,

Thanks for commenting and your kind words. Bill is a wealth of knowledge and we were grateful to have him join us on our group call. Concerning the Acts yes there has been much research and time spent creating training to make sure we can all continue investing safely.

With regards to selling mobile homes on private land to end users while holding secured financing after the Safe act and Dodd frank our advice and training will have you follow the steps outlined in Dodd frank to sell dwellings legally following the “8 ability to repay” criteria outlined by the acts. In addition we use Loan originators that are Safe act approved when dealing with mobile home attached to private property. This is of course a nutshell version however in short we simply follow the rules as written. Let me know if you have any further questions or you do not understand something I mentioned above.

Talk soon,

John

Chastity Fellows

September 21, 2014Hi john,

I couldn’t find this info anywhere else online. Thanks a bunch. Also sort of a funny thing happened. I could not listen to the audio on my phone but when I went online I was able to listen to it fine. Then I saw your comment right about the seminar audio and felt dumb. haha, any thanks again.

John Fedro

September 25, 2014Hi Chastity,

Thanks for reaching out and commenting. You are not the first one to tell me this and I am glad that you were able to listen to it. Do not feel silly as this happens to the best of us. In fact missing something that is “in front of you” is why and how being trained helps so many investors, including myself. It is always great to stand on the shoulders of people who have already succeeded in any business or sport or new endeavour we plan to take. Hope this makes sense and let me know should you have any other questions.

Talk soon,

John

Phil Secrett

November 14, 2014Great articles john. Stay keeping putting out great content and the good work! You realize, a lot of people are searching around for this info, you can help them greatly.

Sincerely,

Phil

John Fedro

November 14, 2014Hi Phil,

Thank you very much for the kind words and for commenting. I am here if you any assistance moving forward in this business or simply have related questions.

All the best,

John

Eric Bastille

November 26, 2014Hi John,

Great stuff and am happy to hear there are options with regards to DF. I am so happy I found this article! Wonderfully done and you and Bill W make a lot of sense. I treasure the fact that someone as giving as you two are in this business too. Great work and please don’t stop. You’re an inspiration to me and a lot of other investors I talk to.

Sincerely,

Eric Bastille

John Fedro

November 28, 2014Hi Eric,

Thanks for commenting and your kind words. We were very fortunate to have Dodd Frank expert Bill Watson on the call with us to help explain an clarify this confusing issue. Yes, there are options with regards to DF, those options all settle around not violating these rules and acts. As investors we have to know how to invest safely without breaking the rules… and still helping others and making a good deal of profit as well. If you have any questions don’t hesitate to reach out.

All the best,

John

Jim Shanabarger

November 30, 2014Hi John

I just finished listening to your conference with Bill Walston that was done in Jan of 2014 about the dodd frank act. Now that we have had 11+ months to find the way to work around this What can we do beside have an unsecured loan.

John Fedro

December 1, 2014Hi Jim,

Thanks for following along, there was much about the forms and procedures that the telesemiar does not go into with regards to how I personal invest and teach. Concerning your question the only way I suggest to “get around” any laws is by not breaking them in the first place. There have not been new strategies to my knowledge that anyone is putting forth, this is because these laws are still being written. At the time of this teleseminar roughly 60% of the Act was written with another 40 some percent still let to be outlined. Other investors have suggested simply staying under your states cap for writing secured notes OR simply hire a residential loan originator to negotiate, screen, and craft all your notes, even still some very risky investors are just investing and selling MHs the same way we used to 10 years ago. I hope this helps.

Talk soon,

John

Keith Parsons

October 28, 2015Hey John

I must have been living in a cave in my own world, because I heard of the Dodd-Frank law, but never really gave it much thought since I thought it only affected regular homes and not mobile homes. With that said, I feel like all the blood has drained from my face, because since Jan 2014 I have created notes on at least 12 mobile homes. Now here is the thing. When I finance people that purchase one of my places I 1)I require a down payment 2)make sure they are gainfully employed with steady job history, 3)I Run credit and 4) Set reasonable terms and interest rate so again they are not over extended and can budget accordingly. For instance a typical scenario would be as follows: Note amount 7000, at 6% interest (that’s lower than banks offering MH financing)with a term of 5 years which results in a payment of $135 a month. There is no balloon, no rate change, no funny business, just a purchase with me carrying remaining balance. And these are older mobile homes that most if not all banks wont touch due to age. Am I running afoul of the law here? I can’t believe it if I am, since in 10 years I have not had one person default on me, because I make payments reasonable. Thank you for any input

John Fedro

November 3, 2015Hi Keith,

Thank you for reaching out and commenting. These laws certainly do apply to mobile homes as well as traditional site built properties. While there has been no case law that I know of with regards to investors being punished in court for violating these acts, these days are likely coming. My hats off to you for operating a quality and win-win investing business. It is very clear to see from your words you wish all your tenant buyers to fully pay off their homes that they love so much. I’m so glad to hear and proud that you have never had a default in 10 years, that is very impressive. Are you creating any type of mortgage or collateral of the subject property for this debt? If you are doing this thing you are likely violating these new laws.

Keep in mind I’m certainly no real estate attorney and that I only have a basic understanding of the law. With that said there are much bigger investors continuing to write their own notes and mortgages on many dozens of homes a year without following the law. Can you be found guilty and penalized if one of your tenant buyers decides to get litigious? The answer may likely be yes. However while this is possible, it is not probable. I say this based on your track record of selling quality homes at reasonable prices. If you did wish to change these over to safe act and Dodd Frank approve loans could certainly do so with the help of a mortgage loan originator locally.

With that said I encourage you to seek the counsel of a local real estate attorney that understands these laws in your business strategy. If you have any additional questions or concerns never hesitate to reach out and ask me anytime. Always here to help.

Lastly, what state are you investing in? If I have any additional information concerning your state I will certainly let you know. Keep in touch.

Talk soon,

John

jim

January 22, 2016uh oh – I’m coming late to the game it seems. I have 4 mobile homes in parks I sold to buyers on purchase contracts where I hold title until they pay it off.

Does this make me a bad person subject to violating this dodd frank thing?

Just found your site and lots of great videos, John F – my wife and I really appreciate you. looks like we have to stick around or risk going to jail 🙂

Jim

John Fedro

January 22, 2016Hi Jim,

Thanks for reaching out and connecting. I’m always interested in meeting other active real estate investors. Additionally, thank you for the kind words about the site. Very happy to help.

What is done is in the past. Additionally, it sounds like you are a fairly small fish so I would not worry about anything legally happening against you at this point. With that said it is important that you do not commit fraud or mislead your buyers. If they feel wronged and they certainly may file a complaint against you.

While I do not know you I certainly cannot say if you are a “good” or “bad” person, however simply being ignorant of new laws does not make you a bad person. Thanks again for commenting and if you ever have any follow-up or specific questions never hesitate to reach back out. Have a great weekend and keep in touch.

Talk soon,

John

Mark

February 17, 2016John,

Great information on investing in mobile homes. This business was much easier before the requirements of the Safe Act and Dodd Frank. You have done a very good job of laying out the details on how to stay compliant when investing and I really appreciate that.

I am having a very difficult time finding an RMLO that would be willing to originate loans for me. I have multiple parks throughout the US and was looking for somebody who could do business in multiple states. Do you know of anyone who operates in the west? California, Arizona, Nevada or in the Midwest? It seems that if someone could help park owners originate loans on a national scale there would be some great money to be made by just pushing some paper around.

Anyway, if you have any advice on this I would appreciate it.

Thanks

Mark

John Fedro

February 18, 2016Hi Mark,

Thank you so much for commenting and for your kind words. Congratulations on owning a number of parks across the country. I have no doubt that this came from much hard work and daily effort on your part. Well done again. Concerning your questions about an RMLO in the western states, I do not know of a single originator that operates in all of these states. With that said, I am working with folks in these three states and can likely ask around to get you some recommendations on MLOs. The suggestion I have for the folks I work with is typically to reach out to local real estate investor associations in the area. These groups and clubs will likely have very good recommendations for MLO’s they can recommend and trust. I wish I could be a more specific help to you in this matter. If you have any follow-up questions or concerns please never hesitate to reach out anytime. Keep in touch.

Talk soon,

John

[…] price within 20 days. Consider selling on payments for a faster sale. Be advised that there are new mobile home owner financing laws to be concerned about while reselling to a owner-occupant buyer who will be living in the […]

[…] Mobile Home Investing: 2014 Safe Act and Dodd Frank Act – Welcome back, Thanks for visiting. In this discussion we are going to briefly outline the Safe Act and Dodd Frank Act, and discuss how you may choose to safely move … […]

Leave A Response