Purpose of this page

This page discusses transferring a mobile home’s ownership from a seller to a buyer in the great state of Texas. This is not intended in situations where the land the mobile home sits on is included in the sale. If the land is included in the sale please reach out to a local real estate attorney to help facilitate your closing. However if you are dealing with an individual mobile home located in a pre-existing mobile home park, on somebody’s rented land, in a lot, or somewhere else than please see the information below.

In the state of Texas the process to transfer a mobile home title from one owner to the next is fairly simple and straightforward. Please see the steps and tips below when considering purchasing or reselling a mobile home in the state of Texas.

Disclaimer: This page is not intended for mobile home investors. The reason this is mentioned is because you may require extra documents and agreements if you are a mobile home investor. These extra documents would include an after closing agreement if the seller was remaining in the home for a bit after closing, personal property trust agreements, a promissory note or lien paperwork, power of attorney, and more. Below is the minimum paperwork required to successfully transfer ownership from one party to another.

Prior to your mobile home closing

Verify seller is the owner on record: Ask to see a copy of the home’s Statement of Ownership and Location (SOL) and tax receipt/bill during your initial walk through of the mobile home. The seller may be willing to text message a picture of these to you to verify the seller’s name is on these forms as owner. Also, write down the mobile home’s Serial number, VIN, Seal number, or Label number if possible. These identifying numbers will be needed while looking up taxes and liens.

Interesting Texas MH fact: In 2003 Texas stopped using paper titles to provide/prove ownership for mobile homes, and replaced paper titles with electronic Statements of Ownership and Locations or SOLs. This information is stored online and therefore does not require the need of a paper title. This allows a way for the state to try tracking and taxing every mobile home no matter the age or condition. This also allows for an online database of records.

Check for back taxes: In Texas almost all mobile home records are kept in a central online database. This database’s information usually includes current liens and property taxes owed on the specific mobile home. Click the green button below to be taken to the Texas SOL owners database for the public. Once on this page use the home’s serial number or label/seal number (see below) to locate the home’s records and verify if taxes are current. Tip: Although this taxes/liens may seem current/paid online, double-check this info by calling the Texas Department of Housing and Community Affairs (TDHCA) at 800-500-7074. Taxes must be current prior to title transfer.

Check for hidden liens: Same as above.

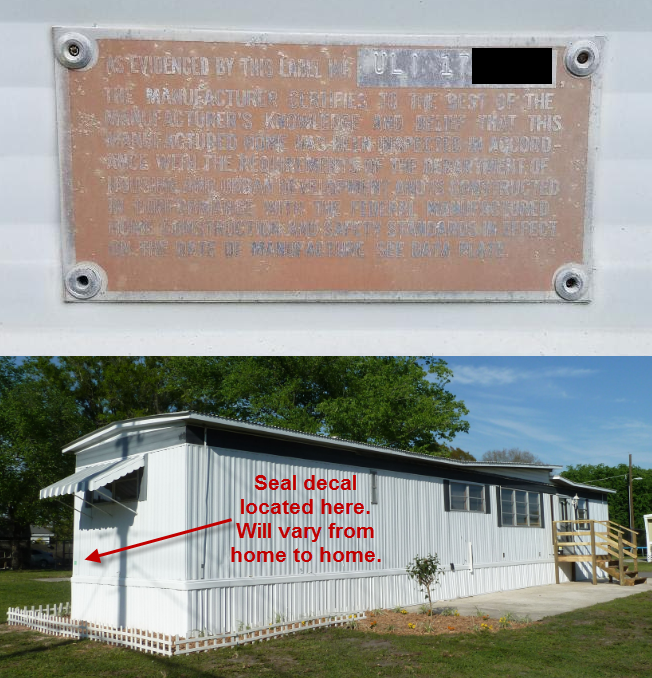

Check for Texas Seal or Hud Label: A Texas Seal is a metal plate with a number that is used to identify a manufactured home that does not have a HUD Label. Texas law requires that a manufactured home have either a HUD Label or a Texas Seal attached to it before any sale of the home.The Texas seal is a metal decal typically found at the rear of the home. The Seal/label number is a number that HUD assigns to each section of each manufactured home; for example a double wide will have 2 seals/labels and a single-wide will have only 1. Seal/label numbers always have a 3 character prefix, such as TEX. The prefix is always followed by 7 digits, such as 0012345. The entire number is 10 digits. Examples of complete Seal/label numbers: TEX0012345, TXS0045678, ULI0087654

If No Seal or Label is found? This may be for a variety of reasons. If there is/are no HUD Label(s) or Texas Seal(s) on your home, a Texas Seal will need to be purchased and will be issued to each section of the mobile home at an additional cost of $35.00 per section of home. Single-wides add $35 and double-wides add $70. (See fees below in final section) This “No label or no seal” will be notated on the SOL Application section 2(b) described below.

If inside a mobile home park aim to speak with the community manager to 1.) become park approved, 2.) verify the seller is current on all payments, 3.) ask for a copy of the park rules, 4.) ask if lot rent is increasing in the near future, and 5.) if the park manager see any needed improvements to the mobile home if/when you purchase the home?

Sellers claim only a Bill of Sale is needed to sell? Do not give the seller any money yet. First, contact the Texas Department of Housing and Community Affairs – Manufactured Housing Division at 800-500-7074 or 512-475-2200 and explain your exact situation.

Prior to your mobile home closing – Continued

Statement From Tax Assessor-Collector from the local tax collector’s office is needed. This form shows taxes are paid and current. Seller should ideally obtain this prior to closing to provide to seller. Seller may pay for taxes and obtain a Tax receipt from the local tax collector’s office.

Disclaimer: This Statement from Tax Assessor-Collector or tax receipt is from the tax office directly. The owner will receive this tax receipt when taxes are paid yearly, this will work in place of the Statement from Tax Assessor-Collector form mentioned. If the owner has lost the receipt then the buyer or seller must physically go to the tax collector’s office to obtain a new receipt or the Statement from Tax Assessor-Collector form. A printed copy from a home computer will not work, it must come directly from the tax office.

If the seller fails to obtain a Tax Receipt, then [as buyer] it is important to act smart. 1.) Fill out all forms needed as described on this page. 2.) Call your local tax collector’s office to find out back tax amount and total fees to obtain a Tax Receipt for this mobile home. 3.) Close with seller and get all needed forms signed by seller(s). Pay money to seller, however deduct taxes owned to county tax collector’s office from money to seller. 4.) Now go to local tax collector’s office to pay back taxes and obtain a Tax Receipt. 5.) Next, see below.

If purchasing or selling before October: Be aware, the seller (or you if the seller has no funds) will be required to place the current year’s taxes in escrow with the county tax office before the tax collector will provide this Tax Receipt you need.

Behind on mobile home personal property taxes?

Since 2021 the Texas Department of Housing and Community Affairs has told each Texas county tax collectors’ office they are only allowed to legally charge you for the last 4 years of back personal property taxes. In short, the TDHCA told the county tax offices to take tax-payers to court for their back due mobile home personal property taxes, or risk losing any back taxes over 4 years old.

This rule applies to any mobile home that is personal property in the state of Texas. Few exceptions apply.

Example: Mobile home shows 10 years of active back taxes. You may pay for the last 4 years only, and the county is required to remove the remaining years at no charge.

See Official Letters from the TDHCA to every County Tax Office. The links below:

At Closing

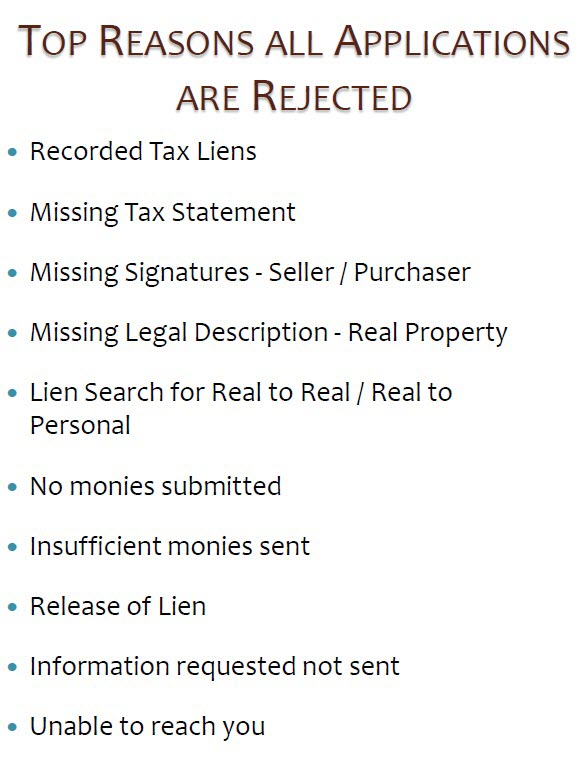

Paperwork needed: SOL Application (must have and be signed). No notary is needed. Tax Receipt or Statement from Tax Assessor-Collector (must have – for previous and current year taxes paid), Bill of sale (Suggested – You may create this by hand or this generic Bill of Sale here.) No notary is needed.

Pro Tip: If purchasing the mobile home perform one last walk through before closing and handing over any money. The seller wants your money just as bad as you want the property. If there are any surprise repairs needed or trash/furniture you may have to remove then adjust the price accordingly.

Adding a Lien

If for some reason a lien needs to be placed on the new SOL, this will be done while filling out the SOL application in the #8 block of the application. See below

After closing – Transferring ownership

Double check to make sure that the SOL application is filled out, signed, and dated correctly by all parties. Make sure that the previous and current year taxes have been paid-in-full and you are in possession of a receipt from the tax collector showing these taxes are current and paid. Now gather the SOL application, tax receipt, copy of the signed bill of sale, and check made out to the Texas Department of Housing and community affairs together.

Fees: See the SOL-Fee schedule here. Double-check by calling the Texas Department of Housing and Community Affairs at 800-500-7074 to verify the exact cost to transfer the home’s ownership into your name.

Mail forms and payment to: Texas Department of Housing and community affairs. PO Box 12489 Austin, TX 78711

Buyers: Mail all forms as soon as possible to avoid penalties or complications.

Sellers: Make sure to stay in communication with the buyers to verify that they have mailed all forms to the state in order to change ownership. Verify this ownership change has made online using the green button above. Some sellers wait months or years to transfer ownership. This can cause property taxes to accrue in your name while you technically still own the mobile home. If the buyers refuse to transfer the ownership into their names you may want to mention that as the mobile home owner you will resell it to another buyer that is willing to transfer the property into their name.

Allow 2-4 weeks for a new Statement of Ownership and Location to be returned to you via mail. Keep this newly state printed SOL in a safe place. However if you lose this SOL it can be replaced and is not required to resell the mobile home in the future.

Taxes moving forward: The new owner will receive a yearly tax bill in the mail.

Additional help: See SOL instructions here for the most common types of sales and further how-to instructions.

We hope that the information above has been helpful. If you notice any errors or improvements, please contact us immediately at support@mobilehomeinvesting.net. As always, if you have any follow-up questions or concerns never hesitate to reach out or comment below any time. All the best.

Love what you do daily,

John Fedro

3 Responses